Business

NicheFinder.Io Is the Fastest Way to Find High Traffic, Low Competition Niches

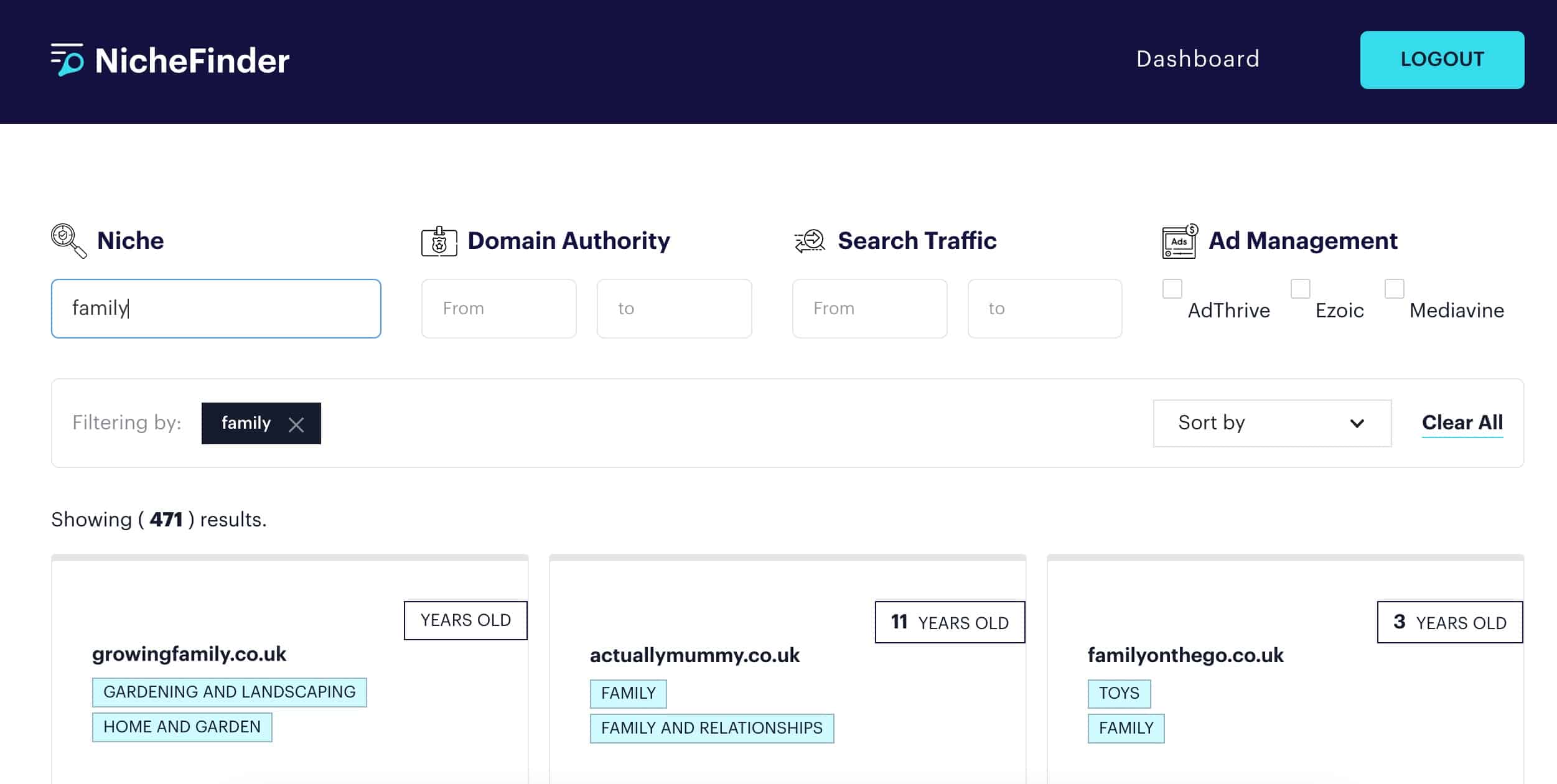

If you are anything like me, you are always looking for niches with high traffic and low competition to target your website or blog. These niches can be difficult to find manually. However, NicheFinder.io can help you do it automatically.

NicheFinder.io is the fastest and easiest way to find high-traffic, low-competition niches. Enter a keyword or topic you want to target, and this tool will quickly analyze hundreds of niche sites to find the ones that are both popular and profitable. It looks at metrics like social shares, backlinks, and monthly search volume, and it also analyzes the competition in each niche based on domain authority, average page load speed, and keyword use.

Whether you’re a blogger looking for new content ideas or an entrepreneur searching for profitable niches to target with your next business venture, NicheFinder.io is the tool you need to find the best opportunities quickly and easily.

Which Niche To Start In

NicheFinder.io answers all your prayers if niche-searching has been a problem. You can quickly access a lot of data to help narrow down your choices and find a niche that will bring you traffic with just a few mouse clicks. NicheFinder.io offers helpful tips and tricks for dominating your niche.

Quickly Analyze Any Niche’s Landscape

NicheFinder.io can be used to analyze any landscape quickly. NicheFinder.io allows you to enter keywords or niches and will display all of the competitors. To limit your search results to domains that have a certain amount, you can filter by monthly search traffic. NicheFinder.io can be used to quickly and easily analyze any landscape.

Smart Filters Help You Find Your Perfect Niche

NicheFinder can be used to create a blog or authority website. With just a few clicks, you can filter through more than 10,000 domains to quickly find high-traffic and low-competition niches. The niche Finder is fast and accurate. It’s easy to use.

Understanding Your Competitor’s Monetized Ad Network

NicheFinder.io provides the best way for domains that have been filtered through ad networks. Our powerful search engine makes it easy to find parts powered only by certain ad networks like AdThrive, Mediavine and Ezoic.

About NicheFinder.io

NicheFinder.io makes it easy to find low-competition, high-traffic niches for your next blog or authority site.

Which Niche is the Most Profitable for Blogging

It is impossible to say which niche is most lucrative for blogging. NicheFinder.io and allow you to quickly identify high-traffic and low-competition areas that will be perfect for your next blog. NicheFinder’s valuable tips and tricks will help you dominate any niche. Don’t delay! Get started today and find your niche with NicheFinder.io.

Business

Unlock Online Wealth: 7 Steps to Startup Success

In today’s digital age, setting up a startup to make money online has become an increasingly attractive option for aspiring entrepreneurs. With the right strategies and tools, you can transform your passion into a profitable online venture. Let’s explore the key steps to launch your own money-making startup in the digital realm.

1. Identifying Your Perfect Business Niche

The first step in your online startup journey is finding the right niche. This involves assessing your passions and skills, researching market demand, and analyzing the competition. By identifying gaps in the market, you can position your startup for success.

Consider exploring niches like online courses, as highlighted in the book “Launching Your Online Course Empire”. This guide provides step-by-step instructions for building a successful online courses business, which can be a lucrative avenue for those with expertise to share.

2. Crafting a Robust Business Plan

Once you’ve identified your niche, it’s crucial to develop a comprehensive business plan. This document will serve as your roadmap to success, outlining your goals, financial projections, and marketing strategies. Learn more about business planning

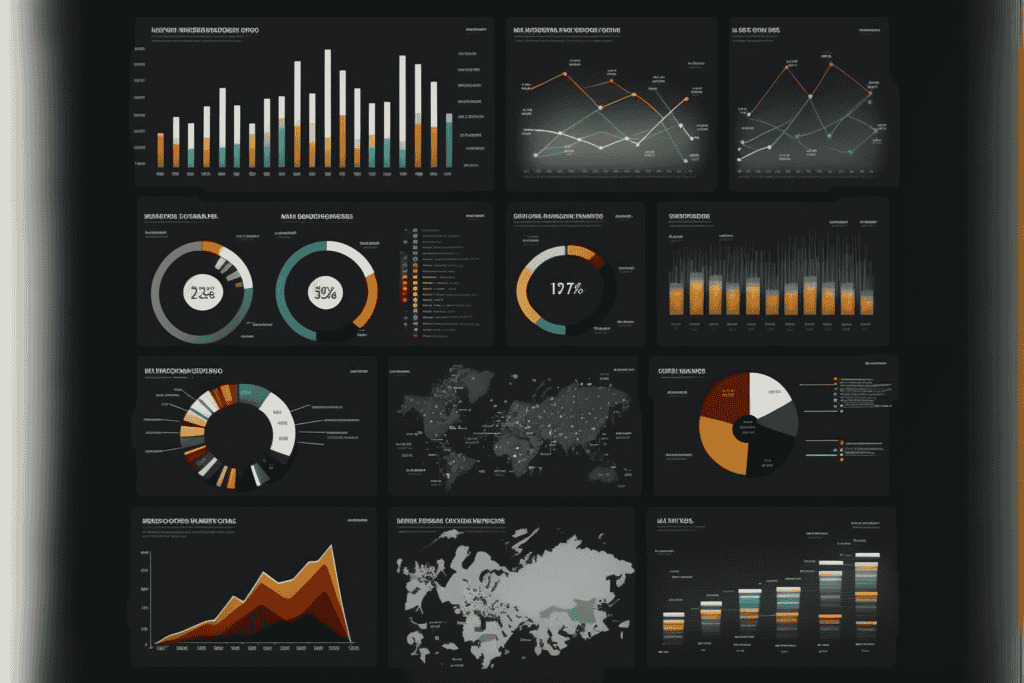

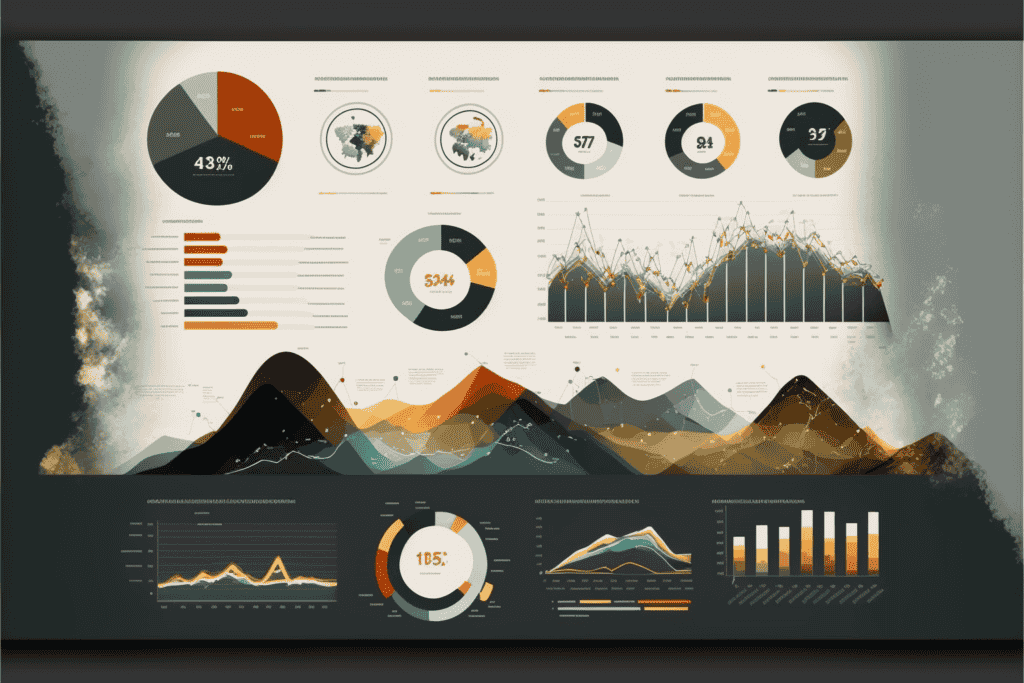

Importance of Business Plan Components

3. Building Your Online Presence

In the digital world, your online presence is your storefront. Start by choosing the right platform for your business, whether it’s an e-commerce site, a blog, or a service-based platform. Design a user-friendly website that reflects your brand and implement e-commerce functionality if you’re selling products.

Explore marketing strategies for your online presence4. Funding Your Online Startup

While many online businesses can be started with minimal investment, you may need additional funding to scale. Consider various options such as bootstrapping, crowdfunding, or seeking investors.

Consider leveraging tools like Self to boost your credit score and increase savings, which can be crucial when seeking business loans or investments. Additionally, focus on maximizing your brand’s value, as this can be essential if you’re considering future acquisitions or partnerships.

5. Launching and Growing Your Online Business

With your foundation set, it’s time to launch your online startup. Develop a strong launch strategy and implement effective marketing tactics to gain traction. As you grow, focus on scaling your operations and continuously adapting to market changes. Discover strategies for growing your business

Market Research

72% of businesses fail due to poor market research

Competitive Analysis

80% of businesses conduct competitor analysis to inform their strategy

Customer Acquisition

82% of companies prioritizing customer experience report increased revenue

Operational Efficiency

60% of businesses use automation to improve operational efficiency

6. Diversifying Your Online Income Streams

As your startup grows, consider diversifying your income streams to increase profitability and reduce risk. This could involve exploring multiple business structures or venturing into new online markets.

Consider leveraging multiple LLCs for asset protection and tax benefits. Additionally, explore side hustles that can complement your main business, turning your passions into additional profit streams.

7. Staying Informed and Adapting

The online business landscape is constantly evolving. Stay informed about industry trends, emerging technologies, and market shifts to keep your startup competitive. Learn from successful entrepreneurs in emerging markets like cryptocurrency

Conclusion: Your Path to Online Startup Success

Setting up a startup to make money online offers exciting opportunities for entrepreneurs willing to put in the effort. By identifying your niche, creating a solid business plan, building a strong online presence, and continuously adapting to market changes, you can pave your way to online business success. Remember, the journey of entrepreneurship is ongoing – stay curious, be willing to learn, and always look for ways to innovate and grow your online venture.

Ready to start your online money-making venture? Explore Startup Sofa’s Startup Essentials resources to kickstart your journey to online business success!

Business

14 Ways to Maximize Your Niche Earnings by 2023 – Cyber Media Creations

Everyone is getting ready for an uncertain economic landscape in 2023. Even if you’re currently not facing financial difficulties, it’s crucial to make sure you’re prepared for any forthcoming circumstances. Concentrate on strategies to increase your earnings through online channels.

You can take a look back at the year to get an idea of what you should do when setting up your online business. Many business models are available, so you will find the right strategy and trends for each.

You don’t want to be more productive as a solo entrepreneur. Instead, you want maximum success in terms profit. This is why you should take actions that are specific and related to your niche. Also, make sure to increase interest in brands that interact with their followers.

Here are 14 ways to increase your profits in the next year. This will allow your business to remain competitive and attract more attention.

#1 – Pick a Niche with Rising Profit Potential

You should choose a niche that offers the opportunity for you to make the type of money you desire, even if you haven’t yet chosen one. To see the trends and to find out what is attracting more attention, you can look back at the past year.

Many people were forced to telecommute during the pandemic. More are now looking for information on how to start an online business and become an entrepreneur.

There are also more homeschoolers than in traditional schools due to the fact that their children thrive in this environment, rather than being bullied and lacking tailored information.

Today’s society is very interested in self-care and stress relief. You can market or create many products that will help your target audience relieve stress and become their best selves.

Any financial assistance that can reduce debt, improve credit scores, or save money will be a major focus in 2023. Experts warn against keeping debt and not having enough money to deal with the economic crisis.

You might also want to focus on the fitness niche. Many people were unable to exercise or move during the pandemic. Now they are ready to get back into shape.

You may have to make changes to your business plan and adjust your marketing strategies, but the potential for success is there. It’s up to you how much you want to earn from your online business in 2023.

The key is to remain focused on your goals and take consistent actions that will propel you towards profitability. With a little planning and hard work, you can become very successful in the years ahead.

#2 – Stay up To Date on Current SEO Trends for Better Rankings

It is important to ensure that you pay attention to solid search engine optimization guidelines. Google and other search engines have identified the most important things to them.

They want their users to have a positive experience with your site. This means that you must cater to your users in order to achieve an organic search ranking above the rest.

Start by making your website mobile-friendly so that anyone can access it on any device. Next, you need to ensure that your site loads in less than 5 seconds.

They should be able to access a wide range of information once they have done so. Your blog posts should be comprehensive and cover a range of topics so that the reader feels satisfied with the information.

Your traditional SEO methods of using keywords and alt text as well as having a good navigation on your website still apply. You should also recommend products to consumers. This is a new guideline from Google for people who want to rank high in search engines.

However, you must also pay attention to the changes in SEO trends and adapt your strategies accordingly. Google’s algorithms are always changing, so it is important to stay up-to-date on the latest best practices.

If you want your business to be successful in 2023 and beyond, then staying up to date on SEO trends will be critical. You need to ensure that your site is optimized for both users and search engines, and that can only be done by following the latest best practices.

Some key strategies include using relevant keywords throughout your content, optimizing images with alt text, ensuring that your site loads fast, providing a user-friendly navigation, including product recommendations where appropriate, and regularly updating your content. If you can implement these tactics consistently, you will likely see improved rankings and increased traffic over time.

#3 – Use Current Events to Increase Your Traffic

You should be aware of current events, regardless of your niche or business model, so that you can increase traffic at an accelerated rate.

Online entrepreneurs tend to be late to the party. They look around and see what others are talking about before they decide to write. A cutting-edge blogger should be discussing newsworthy topics and concepts.

It doesn’t necessarily mean that it must be covered by CNN or Fox news anchors. It simply means that there has been a lot of buzz about it, and people are starting to talk about the benefits or problems related to your niche.

This information can be found on the Google News tab. However, you can also look at what your target audience is discussing shortly.

Read forums, social media posts, and comments to see what topics people engage in.

You may not want to jump into the conversation right away. But, as you continue to monitor online discussions in your niche, you will be able to identify essential issues that can increase your traffic significantly. This is an excellent strategy for becoming more active on social media and reaching out to potential customers at scale.

Overall, staying up-to-date on current events and trends is essential if you want to grow your traffic quickly. By monitoring what others are talking about and leveraging these topics in your content marketing strategies, you can gain visibility and reach more people than ever before. So start using current events today and watch your website traffic soar!

#4 – Become (or Use) a Niche Influencer to Promote Your Site

Online, influencers are a major part of the internet. This may not be what you think it is. A TikTok influencer is more than just someone who performs the latest dance and receives brand deals.

Although that is one type of influencer, niche success can be achieved by many different types. They don’t require you to move your body on the screen. The definition of an influencer has expanded to include anyone who is sought-after by a growing number of people via social media or their blog.

Many influencers can help you in various niches such as parenting, fitness, cooking and even parenting. You can find them in college students who teach their peers how stress can be relieved or elderly grandmothers who want to share her traditional cooking knowledge with a wider audience.

It is impossible to leverage another person’s influence by working with them on promotions for your site or offers. However, you can position yourself as an influencer in your niche and reap direct benefits.

You can also receive payments from your followers, who can gift you items (which can be turned into cash), or participate in the creator funds that specific platforms divide up to those with increasing views. This will increase your income stream.

If you want to become an influential person in your niche and take advantage of the benefits that come with it, start by working on creating valuable content, engaging regularly with your readers or followers, and interacting with other influencers. As you do this, your influence will grow over time, helping you to reach more people and increase traffic for your site.

Becoming a niche influencer is a great way to quickly gain visibility and establish yourself as an authority in your field. So if you are looking for ways to drive more traffic to your website, consider partnering with other influencers in your niche and leveraging their expertise and audience to help promote your brand!

#5 – Put Yourself on the Path to Consistent and Residual Info Product Income

You can increase your niche earnings by becoming an info product creator. There is a right way and a wrong way to do it. Online entrepreneurs who create info products tend to do so once and then drop it.

Be consistent in your product creation. You should have a variety of product slants to suit your target audience. Affiliate marketers can help you increase your income both during and after a launch. They will also be able to promote the evergreen product for commissions.

Information products may not be always eBooks. These products are often memberships. You can use video or text to create these memberships. Your buyers will pay a monthly fee for access to the continuing content you provide.

Once you’ve created the course, you can expect a steady passive income and that your residual earnings will continue to increase month after month. Affiliate marketers find this attractive because they can earn ongoing income rather than just one-time payments.

Creating info products can be a great way to build your income and create a sustainable income stream To get started, start by doing research on the topic that resonates with you most, effective marketing strategies and collaborate with other info product creators to increase your reach and influence in the marketplace. With consistent effort over time, you can steadily grow your business and enjoy consistent earnings from your info products!

#6 – Pull in More Money Using Multi-Media with an Emphasis on Short Form Videos

Multimedia will be a huge boon for your online income in 2023. You will see more people who prefer video or text (or both) to learn and absorb information. The more you cater to them the better your profits will be.

In the next year, there will be a lot of emphasis on short videos. People are less able to pay attention and don’t have the time or desire for a 1/2-hour to an hour-long video to learn.

Videos that last between 15 seconds and 3 minutes have been a hit on every social media platform. This allows you to reduce the information you provide into smaller pieces, making it easier to post more content.

If you want to make the most of online multimedia in 2023, start by focusing on creating short videos that are informative, entertaining, and educational. These will be a great way to reach a wide audience and increase your profits over time!

Overall, if you want to take full advantage of the growing trend of online multimedia and make more money from your content in 2023, focus on developing high-quality short videos that provide value for your target audience. This can include everything from instructional videos to product reviews or marketing tips and tricks. Additionally, try partnering with other influencers who have a strong social media following in order to maximize your reach and visibility. With consistent effort over time, you can build yourself as an authority in your field and increase your income with online multimedia content!

#7 – Make Your Brand a Home for Consumers

A second trend has been observed over the last few years: consumers no longer view brands and influencers simply as people they can buy from. They see them as potential members of a larger community.

People who follow the same brands or individuals often get more engagement than they do. Engage with your target audience via social media. You should be actively participating in the conversation and listening to those who follow you.

Brands can also contribute to the community by hosting events, offering special products and services, or donating to charities. Building a brand that people feel connected to is one of the best ways to increase your income in 2023.

If you want to make the most of this trend and build your brand as a home for consumers, focus on developing meaningful relationships with your target audience through social media platforms. This can include everything from posting regular content updates and responding to comments, to sharing your thoughts on relevant industry news and trends. Additionally, try collaborating with other brands or influencers who share similar values or interests with yours in order to grow your community even further. With consistent effort over time, you can develop yourself as an authority in your field and build a strong, loyal following that can support your brand for years to come!

#8 – Promote a Mix of Products as an Affiliate

You need to be able to promote multiple products if you want to increase your affiliate marketing earnings in 2023. You don’t have to promote digital products only on Amazon or ClickBank.

Instead, search for unique opportunities like monthly subscription boxes. Also, you should look beyond Amazon and other big-name platforms. Instead, look at manufacturers and producers directly for opportunities to promote their products.

To successfully promote a mix of products and maximize your affiliate marketing earnings in 2023, you must also be active on social media. This is where many potential customers are spending most of their time online these days, so it’s important to build a strong presence there.

Additionally, try attending conferences or trade shows in your industry where you can meet people and form partnerships. By diversifying the methods you use to promote products as an affiliate marketer, you can increase your income over time!

#9 – Use Readymade Content and Repurpose It for More Traffic

You can use private label rights (PLR) to increase your online traffic and sales. This is content you can edit and make your own, which will give you more reach in your niche.

This content can be placed on your blog to draw more traffic. You can also use it on social media to drive traffic to you site and offers. Additionally, you can package it as an information product to sell it to your followers and subscribers.

If you want to take advantage of the power of PLR content to increase your online traffic and sales in 2023, start by researching which topics are most relevant to your audience. Then, look for vendors or authors who specialize in creating this type of content.

Finally, be sure to edit and format the content to align with your brand voice and messaging. With consistent effort over time, you can begin using readymade content to drive traffic, leads, and sales!

#10 – Tap Into These 3 Methods to Level Up with Your Offers and Earn More

There are three ways to increase your earnings if you own your online offers. You can first work to increase the number of upsells and downsells in your funnels.

A high-ticket offer can also be created. You can also create a high-ticket offer that includes a bigger product or a coaching program where you work one-on-one with someone or in a group setting.

Your followers can pay to access gated content. This is information that is password-protected and is available only to those who pay. It is not open to the public.

You don’t want your 2023 success to be a resting on your laurels, hoping that more people find you. It is essential to be proactive and implement strategies to increase brand awareness and traffic to your website.

Doing so will allow you to grow your affiliate income and build your business. Follow these tips to get started!

#11 – Build Your Email List as a Priority

Even though many businesses now get a lot of their traffic from social media, email marketing is still one of the best ways to turn leads into customers.

Building an email list should be one of your top priorities as an affiliate marketer, particularly as you start to increase your traffic.

To build a strong email list, you need to offer high-quality content and valuable offers that resonate with your target audience. You can also use social media and other marketing tactics to drive people to sign up for your list.

Additionally, be sure to segment your email subscribers so that you can send more personalized messaging based on their interests and preferences. If you put in the time and effort to build a robust email list, it will pay off in increased sales and profits over time!

#12 – Engage Your Audience Consistently on Social Media

To capture the attention of potential customers online in 2023, it’s critical to engage your audience consistently on social media. This means posting high-quality content regularly and engaging with people in your niche.

One key strategy is to join relevant groups and forums where you can interact directly with others who are interested in the same topics as you are.

Additionally, try using paid advertising or influencer marketing campaigns to reach a wider audience and grow your social following. With consistent effort and attention, you can build an engaged community that will help fuel long-term growth for your business!

#13 – Focus on Quality over Quantity When Creating Content for Your Website

As an affiliate marketer, it’s critical that you focus on quality over quantity when creating content for your website or blog. This means providing valuable information and resources that will help your target audience, rather than simply creating content for the sake of cranking out more posts.

One effective strategy is to use an editorial calendar to plan your content in advance and organize it by topic or theme.

You can also try incorporating user-generated content from social media into your blog and repurposing high-quality existing content on your website.

With quality at the forefront of your efforts, you can build a strong foundation for long-term success as an affiliate marketer!

#14 – Diversify Your Traffic Sources to Grow Your Profits

As an affiliate marketer, it’s essential to diversify your traffic sources in order to maximize profits over time. This means continually experimenting with new marketing tactics and strategies to reach a wider audience.

Some effective tactics to consider include guest posting on other websites, leveraging social media ads, partnering with influencers in your niche, and running paid traffic campaigns through Google AdWords or other platforms.

By diversifying your efforts and trying different techniques, you can maximize the number of people who are exposed to your brand and affiliate offers!

Overall, as an affiliate marketer in 2023, it will be important to continue growing your brand awareness and expanding your reach online. With some time, effort, and commitment to quality content, you can build a solid foundation for long-term success in this exciting industry!

Do you want to succeed as an affiliate marketer in 2023? Whether you’re just starting out or looking to take your existing efforts to the next level, there are a few key strategies that can help. In this guide, we’ll outline some of the top tips for affiliate marketers in 2023, including:

- Creating high-quality content and offers that resonate with your target audience.

- Building an engaged community on social media platforms and other marketing channels.

- Diversifying your traffic sources to reach a wider audience and boost profits over time.

If you’re ready to start building a successful affiliate marketing business in 2023, follow these tips and put in the necessary time and effort to achieve your goals! Good luck!

Originally published at https://cybermediacreations.com on January 1, 2023.

Maximize Your Niche Earnings FAQ

What is affiliate marketing?

Affiliate marketing is an income model where you earn a commission for selling products or services on behalf of other businesses. It can be done through programs, like Amazon’s affiliate program, or directly with manufacturers and producers.

How do I maximize my earnings from affiliate marketing?

One key strategy is to focus on quality over quantity when creating content for your website or blog. This means developing valuable and relevant resources for your target audience, rather than simply pumping out large volumes of generic content. Additionally, you can try diversifying your traffic sources by utilizing paid advertising campaigns, engaging with influencers on social media, and partnering with other businesses in your niche to reach a wider audience. With these strategies and others, you can grow your profits as an affiliate marketer over time!

Business

10 Ways to Write Highly Converting Sales Copy – Cyber Media Creations

Numerous marketers who are either encountering challenges or are new to the field will share that the toughest part of their business is presenting a product to the market when there’s no guarantee it will be well-received.

They spend a lot of time polishing their eBooks or videos, only for sales to plummet and their affiliates to disappear.

Many online entrepreneurs don’t succeed because they haven’t made an effort to learn sales copy. They believe the product is excellent and should sell by itself.

They feel that providing the facts on the sales page is sufficient, when paired with a price point that will convert buyers into customers. You will notice that every successful launch online has one thing in common. It isn’t the quality of their product. It is the creation of quality sales copy.

Key Principles and Techniques of Writing Effective Sales Copy

Writing compelling sales copy that can turn leads into long-term customers requires a few key principles and techniques. Firstly, it is essential to take the time to understand your target audience in order to craft content that speaks to their interests, needs, and concerns. This could involve conducting market research or analysing customer feedback from previous campaigns. Knowing what motivates potential customers will ensure that your messaging resonates with them on an emotional level.

Secondly, it is important to create titles and headlines that are attention-grabbing and convincing enough for readers to click through. An effective headline should succinctly summarise the benefits of the product or service being promoted in a manner that piques interest. Additionally, including terms such as ‘free’ or ‘exclusive’ can help draw more attention to the offer being made.

Thirdly, persuasive language must be used throughout the copy in order to encourage prospects towards making a purchase decision. This involves using active verbs such as ‘discover’, ‘learn’ or ‘experience’ while explaining how they can benefit from the offering being made. Furthermore, stories have been shown to be very effective in creating strong connections with leads and inspiring them to take action. That is why it is important to build narratives around your product or service which demonstrate its unique value proposition and showcase real examples of how it has helped others succeed.

Finally, when writing effective sales copy always keep an eye on linguistic nuances such as tone of voice and word choice which can make all the difference between success and failure. Using language which builds trust and credibility will not only increase conversions but also have the potential to turn leads into loyal customers over time..

Ten Ways to Write Highly Converting Sales Copy

Here are 10 sales copy tips to help you launch your next campaign. Instead of having visitors leave your sales page or having your affiliates not respond to your recruiting efforts, you can enjoy the profits that you deserve.

#1 – Start with Professional Graphics and Formatting to Deliver Your Message

Many inexperienced marketers don’t realize how important sales copy graphics are. A professional-looking sales letter designed for a brand gives your website a professional look and instantly conveys professionalism.

When you create copy for your launch, it is crucial to consider everything from the font size and style to the color patterns. Images, videos and other graphics should be used to draw attention to important messages and draw attention to them on your sales pages.

Even using strategic white space in your sales letter can be an effective way of impacting visitors when they scroll through your content, encountering various headlines, bulletpoints, testimonials, and other elements.

You can outsource graphics creation if you’re not a skilled graphic designer. It doesn’t take $10,000 to hire a graphic designer, but it is possible to find someone with the skills and talents you require on Fiverr.

Many page builders have sales letter formulas built into them. You can just plug your content in where it is needed, and it will look professional.

#2 – Nail Down Your Demographic Before You Write a Word

Before you start writing your sales letters, it is important to imagine who that person will be reading them. It is crucial to understand your target audience or demographic before you can write a message that addresses their needs.

The sales letter should be written to the customer and address their goals and pain points. This will make them feel like they are finally understood and can help.

It is important to consider all demographic data that can help you sell to the right people. Are they predominantly men or women? Which age group are they targeting?

Are they concerned about their finances? Is their pain limiting their ability live life to its fullest? These emotions are what you want to be able tap into and create a picture of them as the most likely to benefit from your product.

#3 – Highlight the Benefits and Pain Points in Your Copy

When writing sales copy, there are two messages that you should convey. The benefits the person will receive if they buy your product.

Is your product helping them to save money? It will increase their productivity and efficiency. It will bring happiness into their lives. It will make them look better.

They should be imagining their future after purchasing and using your product to its fullest. These are the benefits they will get in the end. But, it is important to address the pain they are feeling.

It may be physical pain, or it may not. It could be emotional discomfort, sadness or financial problems.

#4 – Spend a Lot of Time Tweaking Your Headlines to Perfection

Your headlines are the area of sales copy you pay more attention to than others. Your headlines are the most important part of a sales letter. It’s the one that stands out in a bolder font for the reader.

There will be multiple headlines in your sales letter. Each one will have a goal to grab the attention of the reader and point out a benefit or pain point.

Many people only read the headlines in sales letters. You want them to be clear and concise.

#5 – Back Up Your Statements with Proof If Possible

If you want your product to convert at a higher level, it is a good idea to include proof in your sales letter. You can have proof in many formats. You may have seen information products on the Internet that show proof of earnings.

These screenshots can be taken from their account. Other types of proof that you can include on your sales copy are statistics and other numerical data.

A screen shot of a news article can be taken by searching the internet. This image can then be used to create your sales copy. To prove that your claims about your product are true, you can do a case study.

#6 – Infuse Strong Emotions in Your Copy

It would be difficult to sell if you wrote a cold, sterile sales letter. Consumers want to feel compelled to act.

You can use many emotions in your sales copy. Your message should be powerful and resonate with your audience. You can use fear, envy, worry, and other emotions.

Fear can be a powerful emotion to use in sales copy. It could be fear of losing out or fear of what might happen. If you want to communicate the emotions that your customers will feel once they use your product, you might use happiness.

Your content can convey an emotion as a whole, but every element, such as the images you use and the buzzwords you use, can also contribute to that emotion.

#7 – Tap into Social Proof by Using Real Testimonials

When someone scrolls through a sales letter and comes across a testimonial, it is common for them to stop and read what others think about your product. This allows them to determine if it is a good fit.

It is important to not use fake testimonials. Real evidence should be provided to show that your product has real value and is effective for your target audience.

You can arrange for testimonials to be sent to you if your product is still in development.

You can approach individuals to give them a review copy and ask permission to use their feedback. If they are willing, you may ask them to send a video.

You can also monitor for positive feedback from your customers. If someone has had a good experience, they can let you know if you could use their comments on your sales page.

#8 – Hit Them with a Strong Call to Action at the End

The call to action statement is located near the end your sales letter. This is where you will emphasize the urgency for them to act now. There are many call to actions statements. You can often find a free swipe file online that you can modify and make your own.

These short, concise statements tell people what they should do. These aren’t long sentences or vague. You can use phrases such as “Order Now and Get 50% off,” “Act Fast and Get A Free Bonus,” and “Join Today to Get Grandfathered In at the Best Price!”

#9 – Have an Element of Real Scarcity Built Into the Offer

You should include scarcity in your sales letters. However, you must not use it in a way that is misleading to your customers. Many marketers use scarcity to ruin their reputations.

If an offer ends at midnight, it must end at midnight. If you state that the price will increase after 10 sales, then the price must rise in the 10 subsequent sales.

You should use scarcity as a motivator for people to make quick decisions about purchasing your product. False claims can damage your credibility, regardless of whether it is urgent or limited in numbers.

A countdown timer can be used to instill scarcity, without the need for any words. Some people have countdown timers that automatically reset for each visitor. They are eventually embarrassed and caught.

#10 – Split Test and Optimize Your Sales Copy Continually

Split testing is a great way to create high-converting sales copy. This involves comparing two concepts, also known as A/B testing. A good copywriter knows that the first draft is not always the best.

Start your launch with two versions the same sales letter. You can only change one element between the two versions, like the headline or type of button.

Split testing a call to action might be a good idea to test its effectiveness against another. You will want to track the conversions of each version after you have sent it to a group.

You will then take the winning version, create two versions, and change one element before you send it to another target audience.

Split testing of the same element such as the headline or call-to-action on the page might be a good idea. Or you could choose something completely new, such the bullet points or testimonials.

Once you have chosen the best version for your sales letter, it is important to keep that in place so that a greater number of people can see how it performs. It takes time to create high-converting sales copy.

Final Thought

With these tips, you can create an effective sales letter that converts more of your visitors into customers. Use this guide to help you optimize the copy and make sure it is clear and concise for your audience.

It is possible to improve your skills by following the 10 strategies and by analysing data to understand how your target audience responds. You’ll find out what works for your audience and will no longer be embarrassed by a poor launch.

Create a sales page using the ten strategies, and you’ll soon make more money from your business.

Conclusion

The sales letter is an important tool for marketing a product, and it can be used to help increase conversions significantly. When writing a sales letter, several best practices must be followed. It should be concise and focus on the product’s benefits rather than its features. Testimonials from existing customers are a great way to show the value of a product. Using a high-quality design is important for boosting conversions.

In conclusion, best practices for creating and optimizing sales letters that convert are to write concisely, focus on the benefits of your product, use testimonials from existing customers, and use an appealing design for the page. By following these tips, you can create a high-converting sales letter that will motivate your target audience to purchase your product.

Originally published at https://cybermediacreations.com on January 2, 2022.

-

Vetted2 months ago

Vetted2 months ago11 Best Gore Websites to Explore the Darker Side of the Internet

-

Music Theory2 weeks ago

Music Theory2 weeks agoUnlocking Nature’s Harmony: The Power of 432 Hz Frequency in Sound & Music for Enhanced Living and Well-Being

-

Vetted1 month ago

Vetted1 month ago15 Best Commercial Vacuum Cleaners for Heavy-Duty Cleaning Jobs

-

Vetted2 months ago

Vetted2 months ago15 Best Essential Oils Brands to Elevate Your Aromatherapy Experience

-

Sound Design2 weeks ago

Sound Design2 weeks agoWhat Is the Difference Between a Sound Engineer and A Sound Designer?

-

Native Instruments Kontakt2 weeks ago

Native Instruments Kontakt2 weeks agoVOCAL AI – Animated Intelligence: The Ultimate Vocal Playground

-

Sound Design2 weeks ago

Sound Design2 weeks agoWhy Sound Engineer

-

Vetted2 months ago

Vetted2 months ago15 Best Concrete Sealers for Ultimate Protection and Longevity