Vetted

11 Best Expense Tracker Apps to Manage Your Finances Like a Pro

We are all aware of the difficulties of managing our finances, but don’t worry, as we have put together a list of the top 11 expense tracker apps that will simplify money management for you.

From tracking daily expenses to creating budgets and analyzing spending habits, these apps claim to do it all. But how do you know which one is the right fit for you?

Stick around to discover the top picks and essential features to consider before entrusting your financial management to an app.

Key Takeaways

- Expense tracker notebooks provide a physical and portable option for tracking income and expenses, with features like sturdy covers and pockets for receipts.

- Expense tracker apps should have an intuitive and visually appealing interface, clear categorization of expenses, and the ability to add detailed notes for each transaction.

- Data security measures for expense tracker apps should include encryption, secure login methods, and secure data storage practices to protect sensitive financial data.

- Additional features for expense tracker apps may include budget tracking capabilities, integration with bank accounts for accurate transaction import, customizable reporting tools, and compatibility with both iOS and Android platforms.

S&O Income and Expense Tracker Notebook (104 Pages, 6.4” x 8.4”)

With its sturdy cover, pocket for receipts, and lay-flat spiral coil, the S&O Income and Expense Tracker Notebook (104 Pages, 6.4” x 8.4”) is the ideal choice for small business owners seeking a convenient and durable tool for efficient money management. This ledger book simplifies complicated accounting tasks, allowing for the tracking of every transaction and providing a snapshot of progress with 52 weekly spreads, 1 annual summary, and 6 note pages.

The elegant mint-colored cover and gold foil print give it a professional appeal, while the straightforward layout makes tracking effortless. The thick 120gsm paper reduces ink leakage and provides a high-quality feel. Customer reviews highlight its size, color, design, and construction, although some express frustration about the limited number of pages.

Overall, the S&O Income and Expense Tracker Notebook serves its purpose adequately for simple financial tracking and is appreciated for its quality and sturdiness.

Best For: Small business owners seeking a convenient and durable tool for efficient money management.

Pros:

- Sturdy cover and lay-flat spiral coil for durability and ease of use

- Elegant mint-colored cover with gold foil print for a professional appeal

- Thick 120gsm paper to reduce ink leakage and provide a high-quality feel

Cons:

- Limited number of pages may frustrate some users

Budget Planner with Bill Organizer and Expense Tracker

and adding more stickers

Customer Feedback:

Customers have praised its simplicity and effectiveness, with suggestions for improvement including highlighting wins and adding more stickers. Overall, it provides a high level of satisfaction with its features and quality.

Conclusion:

When managing our finances and seeking a reliable tool to help us achieve our financial goals, the Budget Planner with Bill Organizer and Expense Tracker stands out as an effective choice. This 6.1 x 8.25 size planner offers a 12-month undated finance planner with twin-wire binding for easy lay-flat 360° access. Its inner pocket for small cards, elastic closure, and premium thick paper make it durable and convenient. The planner helps users learn to earn more money, cut expenses, and change bad spending habits. It also allows for monthly tracking and planning, enabling users to set goals, budget, review, and develop habits and action plans. Those seeking a compact and durable budget planner with comprehensive money management features will find this planner to be the best option.

S&O Budget Expense Tracker Notebook (160 Pages, 6.4” x 8.4”)

The S&O Budget Expense Tracker Notebook (160 Pages, 6.4” x 8.4”) is an ideal choice for individuals and small businesses seeking a portable, comprehensive tool to control personal finances and track spending efficiently. This notebook features 160 pages of thick 100gsm paper, ensuring durability and a high-quality writing surface.

The sturdy cover with gold foil print adds a professional touch, while the lay-flat spiral coil design makes it easy to write on any page. Its inclusion of a pocket for receipts and bills enhances its practicality. Users appreciate its ability to categorize every debit and credit comprehensively, making it easier to track and manage expenses. Additionally, the alternating colored rows facilitate totaling spending with ease.

Its portability and professional design make it a practical choice for managing finances on the go.

Best For: Individuals and small businesses seeking a portable and comprehensive tool to control personal finances and track spending efficiently.

Pros:

- Thick 100gsm paper for durability and high-quality writing surface

- Sturdy cover with gold foil print for a professional touch

- Inclusion of a pocket for receipts and bills adds practicality

Cons:

- Some minor cosmetic issues mentioned by customers

Easy to Use Accounting Ledger Book

Best suited for small business owners and individuals seeking a minimalist and efficient way to track and organize their finances, the Easy to Use Accounting Ledger Book by ZICOTO offers a premium, modern design and ample space for crucial financial information. With its simplified personal finance checkbook format, this ledger book allows users to neatly track and organize their finances, including income and expenses, in a minimalist and easy-to-fill layout.

The sturdy cover and reliable ring binding make it durable and practical for everyday use. It provides practical size and portability, fitting easily into any bag, and can be used as a checkbook register or to track other financial flows. The ledger book also offers ample space to register financial data, compile a trial balance, and manage and organize finances in style.

Best For: Small business owners and individuals looking for a minimalist and efficient way to track and organize their finances.

Pros:

- Simplified personal finance checkbook format

- Premium, modern design with a sturdy cover and reliable ring binding

- Ample space for crucial financial information

Cons:

- May not be suitable for larger businesses with complex accounting needs

Income & Expense Tracker for Small Business (Teal, 5.8 x 8.3)

For small business owners looking for a portable and easy-to-use tool to track income and expenses, the Income & Expense Tracker in Teal (5.8 x 8.3) offers a practical solution with its compact size and comprehensive features.

This teal-colored 5.8 x 8.3 ledger book is designed specifically for small businesses, providing a convenient way to record income and expenses daily, maintain a balanced budget, and develop good bookkeeping habits. With its high-quality 100gsm pure white paper, teal elastic band, and back pocket, this tracker is durable and functional.

It's undated, lasting a whole year and includes a year overview, 53 weekly spreads, 2 pages for annual summary, and 10 notes pages. The portable A5 size fits easily in a backpack, purse, or laptop case, making it a convenient tool for busy entrepreneurs.

Best For: Small business owners and entrepreneurs who need a portable and comprehensive tool to track daily income and expenses.

Pros:

- Easy to manage with daily income and expense tracking

- Portable and compact A5 size, fitting easily into a backpack, purse, or laptop case

- High-quality 100gsm pure white paper and durable teal elastic band and back pocket

Cons:

- Limited writing space for expenses

Expense Tracker Journal Notebook with Budget Planner Sheets

With 120 trackers and monthly and yearly sections, this Expense Tracker Journal Notebook with Budget Planner Sheets is a valuable tool for managing expenses efficiently. The 6' x 9' size makes it convenient to carry around, and the sections for date, description of expense, payment type, and amount provide comprehensive tracking. Using this tracker allows us to record transactions and gain a clear overview of our spending habits.

The instructions are straightforward: simply document when money is spent and include the necessary details. By utilizing this journal, we can effectively budget and manage our finances, gaining insights into our spending patterns and identifying potential areas for savings.

Ultimately, this Expense Tracker Journal Notebook with Budget Planner Sheets serves as a comprehensive tool for tracking and managing expenses, assisting in the creation and maintenance of a budget.

Best For: This Expense Tracker Journal Notebook with Budget Planner Sheets is best for individuals seeking a comprehensive tool for tracking and managing their expenses.

Pros:

- Helps manage expenses effectively

- Provides a clear overview of spending habits

- Assists in creating and maintaining a budget

Cons:

- May require consistent and diligent usage to be effective

Clever Fox Budget Planner & Monthly Bill Organizer with Pockets

Ideal for those seeking to effortlessly manage their household and personal finances, the Clever Fox Budget Planner & Monthly Bill Organizer with Pockets offers a comprehensive solution for budgeting and expense tracking.

With 12 laminated bill pockets, this large format (8×9.5 inches) planner allows for seamless organization of financial papers.

Its durable eco-leather hardcover ensures long-lasting use, and the inclusion of budgeting stickers, a user guide, and a keepsake gift box adds to its appeal.

Users can take advantage of the planner's features to control savings, debt, payments due, bills, and overall expenses, while also setting and achieving financial goals.

With positive feedback highlighting its sturdy design and helpful features, such as bill pockets and expense trackers, the Clever Fox Budget Planner offers a practical and reliable tool for effective financial management.

Best For: Individuals or families looking for a comprehensive and well-organized tool to manage their household and personal finances effectively.

Pros:

- Sturdy and well-organized planner

- Helps with budgeting and expense tracking

- Useful features such as bill pockets, calendar, and expense trackers

Cons:

- Awkward spiral binding

Easy to Use Accounting Ledger Book for Small Business Personal Finance

Small business owners seeking a user-friendly and comprehensive expense tracker app will find the Easy to Use Accounting Ledger Book to be an invaluable tool for managing their finances. This perfect expense tracker notebook for small businesses offers a simplified personal finance checkbook and income and expense log book.

With ample space for crucial information, it neatly tracks and organizes finances, providing a convenient way to manage finances in one place. The undated income and expense tracker is a must-have for small business owners, allowing them to register financial data and compile a trial balance.

Its premium style with a sturdy cover and practical size for easy portability make it durable and long-lasting. The beautiful modern design with abstract aquarelle painting and golden elements enhances the bookkeeping experience.

Best For: Small business owners looking for a stylish and durable expense tracking solution.

Pros:

- Neatly tracks and organizes finances

- Ample space for crucial information

- Undated income and expense tracker

Cons:

- One customer had an issue with printing

My Account Spending Tracker Notebook (2 Pack, 50 Sheets Each)

The My Account Spending Tracker Notebook (2 Pack, 50 Sheets Each) is an efficient tool for organizing and budgeting personal or business finances. With 50 undated sheets in each notebook, totaling 100 pages, this product provides ample space to record transaction type, date, description, tax, payment, and deposit.

Its green foliage design on the front cover and left spiral binding make it visually appealing and easy to use. The notebook's dimensions of 6.25 x 8.5 inches make it the perfect size to fit into a purse, backpack, or laptop bag, ensuring you can keep track of your expenses on the go.

This reliable quality notebook promotes a responsible, worry-free lifestyle by providing a clear view of income and expenses, enabling informed decisions and helping to avoid financial crises.

Best For: Small business owners and individuals looking to efficiently organize and budget their finances.

Pros:

- Ample space to record transaction details

- Portable and convenient size for on-the-go use

- Promotes a responsible and worry-free lifestyle

Cons:

- Limited warranty and support options

Income & Expense Tracker for Small Business (10×7, Black)

For those seeking a convenient and efficient way to track income and expenses for their small business, the Income & Expense Tracker in black (10×7) offers a functional solution. This accounting bookkeeping ledger helps organize finances, classify and summarize income and expenditure, making accounting work easier. It records daily, weekly, and monthly transactions, enabling easy analysis of business statements and improvements. The book is made of high-quality materials, with a functional design that includes a pen bag and inner bag. It's a perfect size for those needing financial records at work and home, and also a great gift idea.

With an average rating of 4.3 out of 5 stars and positive feedback on its usefulness in tracking income and expenses, portability, and ease of use, this Income & Expense Tracker proves to be valuable for small business owners.

Best For: Small business owners looking for a convenient and efficient way to track income and expenses.

Pros:

- Organizes finances and simplifies accounting work

- Records daily, weekly, and monthly transactions for easy analysis

- Made of high-quality materials with a functional design

Cons:

- Some customers desire more variety in the pages and a different format

Budget Planner – A6 Expense Budget Tracker (Teal)

Ideal for individuals who want to conveniently track their daily expenses and manage their personal finances, the Budget Planner – A6 Expense Budget Tracker (Teal) offers a pocket-sized solution with a sturdy cover and useful features.

This teal-colored budget planner measures 3.75 x 6.75 inches, making it perfect for on-the-go purchases and can be easily carried in a pocket or purse. It contains 80 sheets/160 pages with an annual overview, yearly goals page, contact pages, important pages, and lined pages for notes and lists.

The 100gsm thick paper, sturdy and flexible PP cover, strong metal and lay-flat twin-wire binding, inner pocket, and elastic closure ensure durability. Customers have expressed satisfaction with its quality, value for money, and its usefulness in tracking daily expenses and verifying credit card statements.

Best For: Individuals looking for a convenient and portable solution to track daily expenses and manage personal finances.

Pros:

- Pocket-sized design for on-the-go use

- Sturdy and flexible cover for durability

- Useful features for tracking expenses and financial goals

Cons:

- Limited space for detailed financial tracking

Factors to Consider When Choosing Expense Tracker App

When choosing an expense tracker app, we need to consider various factors to ensure it meets our needs.

Features such as expense categorization options and budget tracking capabilities are crucial for effective money management.

Additionally, user interface design and data security measures play a significant role in making the app user-friendly and trustworthy.

Features to Consider

When choosing an expense tracker app, it's important to carefully evaluate its features to ensure it meets your specific needs and requirements.

Consider the size and portability of the app to ensure it fits into your daily routine seamlessly.

Look for a user-friendly layout that simplifies expense tracking and provides ample space for recording essential information.

Additionally, evaluate if the app offers additional features such as receipt pockets, annual summaries, or note pages to cater to your specific needs.

It's also crucial to consider the design and style of the app for a professional and practical appeal.

User Interface Design

Considering the user interface design is crucial when selecting an expense tracker app to ensure a smooth and efficient experience in managing your finances. A well-designed interface should be intuitive, visually appealing, and easy to navigate. Look for apps with clear categorization of expenses, customizable tags, and the ability to add detailed notes for each transaction.

The app should also offer a clean and uncluttered layout that allows for quick input of expenses and easy access to reports and insights. Additionally, consider the app's compatibility with different devices and operating systems to ensure a consistent experience across all your devices.

A user-friendly interface can significantly impact your daily interaction with the app, making it easier to stay on top of your finances.

Expense Categorization Options

We should carefully evaluate the expense categorization options provided by different expense tracker apps to ensure thorough and efficient tracking of our spending. Some apps offer comprehensive debit and credit categorization, allowing for detailed tracking of expenses.

Alternating colored rows can make it easier to differentiate between different categories and total spending.

Additionally, some expense tracker notebooks come with tear-out pages and convenient pockets for receipts and bills, catering to personal expense tracking, household accounting, and small business spending.

Portable options further enhance convenience, enabling easy transportation and use anytime, anywhere.

When choosing an expense tracker app, it's important to consider these categorization options to find the best fit for our specific tracking and organization needs.

Data Security Measures

To ensure the protection of our financial information, it's essential to carefully assess the data security measures offered by different expense tracker apps when making a selection. When choosing an expense tracker app, look for robust data security measures such as encryption to safeguard your data from potential breaches.

It's important to consider apps that offer secure login methods, like two-factor authentication, to prevent unauthorized access. Additionally, opt for expense tracker apps that employ secure data storage practices to keep your financial information safe from cyber threats.

Ensure that the app has a clear privacy policy and transparent data handling practices to protect your sensitive financial data. By prioritizing data security measures, we can confidently manage our finances without compromising our personal information.

Budget Tracking Capabilities

When selecting an expense tracker app, it's crucial to assess its budget tracking capabilities in order to effectively manage personal or small business finances.

Budget tracking capabilities can help categorize every debit and credit comprehensively, providing a clear overview of financial activities. Some expense tracker apps offer features such as alternating colored rows for easy total spending calculations and comprehensive expense tracking.

These apps can also track income and expenses on a daily, weekly, or monthly basis, aiding in the development of good bookkeeping habits and maintaining budget balance.

Additionally, budget planners and expense trackers come in various sizes, including pocket-sized options for on-the-go tracking and larger formats with additional features for comprehensive financial management. Some apps even offer additional features such as annual overviews, yearly goals pages, contact pages, and pockets for receipts and bills to aid in effective organization and management of finances.

Integration With Bank Accounts

Integration with bank accounts is a crucial aspect to consider when selecting an expense tracker app. This integration ensures that all transactions are accurately imported, making expense tracking more efficient. Real-time synchronization with bank accounts offers the advantage of accessing the most current financial data, allowing for better decision-making.

Additionally, bank integration streamlines the process of categorizing expenses and income, saving time and effort. It also reduces the need for manual entry of transactions, providing convenience for users.

When choosing an expense tracker app, the seamless integration with bank accounts not only simplifies the tracking process but also ensures the accuracy and reliability of financial information.

Customizable Reporting Tools

Considering our diverse financial needs, customizable reporting tools are an essential factor to evaluate when selecting an expense tracker app. These tools allow us to tailor the presentation of financial data to our specific needs and preferences.

By creating reports that align with our individual or business requirements, we can gain a personalized analysis of our expenses. Customizable reporting tools ensure that we can focus on the specific metrics that are most relevant to our financial management, empowering us to extract maximum value from our expense tracking data.

Additionally, these tools enable us to generate reports that effectively communicate financial insights to key stakeholders or decision-makers. Ultimately, the ability to adapt the format and content of our reports provides us with a powerful tool for enhancing our financial decision-making processes.

Compatibility With Devices

To ensure seamless compatibility with our devices, it's imperative to verify if the expense tracker app supports both iOS and Android platforms.

It's also essential to consider if the app is optimized for different screen sizes and resolutions, ensuring a consistent user experience across various devices.

Additionally, compatibility with the operating system version of our devices is crucial to guarantee smooth functionality.

Furthermore, it's important to look for information on compatibility with various models of smartphones and tablets to ensure that the app will work effectively on our specific devices.

Lastly, considering if the app integrates seamlessly with other apps or software we use can enhance overall compatibility and streamline our financial management process.

Frequently Asked Questions

Are There Any Specific Tips or Strategies for Using the S&O Income and Expense Tracker Notebook (104 Pages, 6.4” X 8.4”) Effectively?

We've found that using the s&o income and expense tracker notebook effectively involves consistently recording all income and expenses, categorizing transactions accurately, and reviewing your spending regularly.

It's important to set aside time each week to update the notebook and analyze your financial habits.

Additionally, utilizing the notebook's features such as budget planning and expense tracking aids in effectively managing your finances.

How Does the Easy to Use Accounting Ledger Book Differ From Other Expense Tracker Notebooks in Terms of Functionality?

We find the easy to use accounting ledger book differs from other expense tracker notebooks in its simplicity and versatility. It provides a clear layout for tracking income and expenses without the need for complicated software. This makes it accessible to anyone, regardless of their tech skills.

Additionally, the manual input process allows for greater control and customization, making it a valuable tool for managing finances efficiently.

What Are the Key Features That Set the Income & Expense Tracker for Small Business (Teal, 5.8 X 8.3) Apart From Other Similar Products?

We believe the key features that set the income & expense tracker for small business (teal, 5.8 x 8.3) apart from other similar products are:

- Its user-friendly interface

- Customizable categories

- Detailed reporting capabilities

It allows us to:

- Easily track our income and expenses

- Create tailored categories for our specific business needs

- Generate insightful reports to analyze our financial performance

These features make it a valuable tool for managing small business finances effectively.

Can the Clever Fox Budget Planner & Monthly Bill Organizer With Pockets Accommodate Multiple Sources of Income and Expenses?

Yes, the Clever Fox Budget Planner can accommodate multiple sources of income and expenses. It provides sections to track different incomes and expenses separately, allowing for detailed and organized financial management.

With its pockets and dedicated spaces, it's easy to keep everything in order. This feature sets it apart from other similar products, making it a convenient option for managing finances and staying on top of multiple income sources and expenses.

Are There Any Unique Design Elements or Features That Make the Budget Planner – A6 Expense Budget Tracker (Teal) Stand Out From Other Budget Planners?

Sure,

The Budget Planner – A6 Expense Budget Tracker (Teal) stands out with its unique design elements like the color-coded sections and convenient size. It offers a quick and easy way to track expenses on the go.

The teal color and sleek layout make it visually appealing and user-friendly. The pockets and tabs are also handy for organizing receipts and bills.

How Can Expense Tracker Apps Help Me Manage My Kitchen Expenses?

Managing kitchen expenses can be made easier with the help of the best spice racks. These organizer tools not only keep your spices in order but also help you keep track of what you have and what you need, ensuring that you can manage your kitchen expenses more effectively.

Conclusion

In conclusion, managing your finances has never been easier with the plethora of expense tracker apps and notebooks available.

With the right tool, you can track your expenses, stay on budget, and plan for the future like a pro.

So, don't let your finances slip through the cracks – grab one of these apps and take control of your money.

It's time to make managing your finances as easy as ABC!

Vetted

Battle Born Batteries Review: Reliable Power Solution

Unlock the secret to reliable off-grid power with Battle Born Batteries, boasting impressive performance and durability in any weather condition.

I've been impressed with Battle Born Batteries, a reliable power solution offering high-performance lithium-ion batteries. They boast 3,000 to 5,000 deep discharge cycles, making them suitable for off-grid solar systems, RVs, and marine applications. The internal heat technology guarantees all-weather readiness, while the built-in battery management system provides added protection. With a lightweight design and premium aluminum casing, these batteries are both durable and eco-friendly. I've been pleased to see customers rave about their performance, reliability, and customer service, earning them a top-tier reputation. If you're looking for a trustworthy power solution, Battle Born Batteries are definitely worth exploring further.

Key Takeaways

- Battle Born Batteries offer reliable power solutions with 3,000 to 5,000 deep discharge cycles and internal heat technology for all-weather readiness.

- The batteries demonstrate exceptional performance and reliability in various applications, including off-grid solar systems, RVs, and marine uses.

- Customers praise the batteries' consistent power delivery, durability, and long lifespan, with many reporting over 3,000 deep discharge cycles.

- The manufacturer's commitment to quality and customer satisfaction has earned them a trusted reputation in the market for reliable power solutions.

- The batteries' built-in battery management system and premium aluminum casing ensure added protection and efficient heat dissipation for optimal performance.

Internal Heating System Efficiency

As I tested the Battle Born Batteries Lithium-Ion (LiFePO4) Deep Cycle 12V Battery 100Ah GC2 Heated, I was impressed by the internal heat technology that guarantees all-weather readiness. This feature is particularly useful for users who operate in extreme temperatures, as it allows the battery to perform at its best even in freezing or scorching conditions.

Now, let's take a closer look at what I liked about this system and where it could be improved.

What We Liked

I was thoroughly impressed with the Battle Born Battery's internal heat technology, which allowed it to perform efficiently even in freezing temperatures. This feature guarantees all-weather readiness, making it an ideal choice for RVs, campers, and boats. The internal heating system enables the battery to maintain peak performance, even in extreme cold, which is a common limitation of traditional batteries.

| Feature | Benefit |

|---|---|

| Internal Heat Technology | All-weather readiness |

| Long Lifespan | 3,000 – 5,000 deep discharge cycles |

| Versatile Design | Series or parallel wiring |

| Built-in BMS | Protection against various factors |

| Lightweight Design | Eco-conscious and easy to handle |

What Can Be Improved

One area for improvement is the internal heating system's efficiency, which, while impressive, could be optimized to consume even less power while maintaining its all-weather readiness.

Although the system is designed to provide reliable performance in extreme temperatures, I believe it could be fine-tuned to minimize energy consumption. This wouldn't only reduce the overall power draw but also increase the battery's lifespan.

Additionally, a more efficient heating system would allow users to enjoy longer periods of off-grid independence. By refining this aspect, Battle Born Batteries could further solidify their reputation for producing high-quality, reliable lithium-ion batteries.

Quick Verdict

Battle Born Batteries' Lithium-Ion Deep Cycle 12V Battery 100Ah GC2 Heated is a top-tier choice for those seeking a reliable, long-lasting, and high-performance power solution. I'm impressed by its internal heat technology, allowing for all-weather readiness, and its ability to withstand 3,000 to 5,000 deep discharge cycles.

The built-in battery management system provides added protection, and the lightweight design makes it an eco-friendly option. With its versatility in series or parallel wiring, it's suitable for various applications, including RVs, campers, and boats.

Easy Monitoring With Bluetooth

With the convenience of Bluetooth connectivity, I can effortlessly monitor my battery's performance and status in real-time, ensuring peak operation and extending its lifespan. This feature has been a game-changer for me, allowing me to keep a close eye on my battery's health without the need for tedious manual checks.

I can track important signs like voltage, temperature, and state of charge, giving me a thorough understanding of my battery's condition. This real-time monitoring enables me to identify potential issues before they become major problems, ensuring my battery remains in top shape.

The Bluetooth connectivity also makes it easy to update the battery's firmware, ensuring I always have access to the latest features and improvements.

Premium Aluminum Casing Material

I'm equally impressed by the premium aluminum casing material that houses the advanced technology inside, which not only adds a touch of durability but also helps to dissipate heat efficiently. This design choice is a demonstration of Battle Born Batteries' commitment to quality and performance.

The aluminum casing provides excellent thermal management, allowing the battery to operate within a safe temperature range, even in extreme environments. Additionally, the lightweight yet robust material contributes to the battery's overall portability and ease of handling.

Compact Packaging and Accessories

As I unboxed the Battle Born Batteries Lithium-Ion Deep Cycle 12V Battery, I was impressed by the detailed packaging that made it easy to handle and store.

The package includes an extensive user guide, in-depth specifications, and thorough documentation that walked me through the installation and maintenance process.

With all the necessary accessories and information at my fingertips, I felt confident in getting started with my new battery setup.

Specifications

The Battle Born Batteries Lithium-Ion 12V Battery 100Ah GC2 Heated arrives in a compact package, weighing just 31 pounds and measuring 17 x 14 x 12 inches, making it easy to handle and install in tight spaces. This design allows for flexible installation options, suitable for various applications.

Here are some key specifications to take into account:

- Weight and Dimensions: 31 pounds, 17 x 14 x 12 inches

- Amperage and Cycles: 100 Amps, 3,000 – 5,000 deep discharge cycles

- Origin and Warranty: Made in the USA, with a reliable manufacturer's warranty

These specifications demonstrate the battery's versatility and durability, making it an excellent choice for RVs, campers, vans, boats, and trolling motors. With its internal heat technology and built-in Battery Management System, this battery is designed to provide reliable power in various environments.

Documentation and User Guide

In addition to its impressive specifications, the Battle Born Batteries Lithium-Ion 12V Battery 100Ah GC2 Heated also comes with a detailed user guide and compact packaging that includes all necessary accessories.

The user guide provides clear instructions for installation, maintenance, and troubleshooting, ensuring a smooth setup process. The compact packaging is designed to minimize waste and make transportation easier.

Inside, you'll find the battery, terminals, and a thorough manual that covers everything from safety precautions to efficient charging practices. I appreciate the attention to detail in the documentation, which helps to alleviate any concerns or questions I may have had during the installation process.

Features – What We Found

We explored the specifications of the Battle Born Batteries Lithium-Ion Deep Cycle 12V Battery 100Ah GC2 Heated and uncovered a plethora of impressive features that distinguish it from its competitors.

The internal heat technology guarantees all-weather readiness, making it suitable for various applications, including RVs, campers, vans, boats, and trolling motors.

With a long lifespan of 3,000 to 5,000 deep discharge cycles, this battery is built to last.

Its versatile design allows for series or parallel wiring, and the built-in Battery Management System provides protection against various factors.

The lightweight and eco-conscious design make it an attractive option for those looking for a reliable power solution.

Marine Applications Success Stories

I've had the opportunity to use Battle Born Batteries in my marine setup, and the results have been nothing short of impressive. The internal heat technology has allowed me to venture out in cold weather without worrying about battery performance.

I've noticed a significant increase in power and reliability, making my fishing trips more enjoyable and stress-free. The lightweight design has also made it easier to handle and install the batteries.

I've been able to run my trolling motor for extended periods without worrying about the batteries draining quickly. Overall, I'm extremely satisfied with the performance of Battle Born Batteries in my marine application, and I'd highly recommend them to anyone looking for a reliable power solution.

Rating

Battle Born Batteries' impressive 4.6 out of 5-star rating, based on 811 customer reviews, speaks volumes about their reliability and performance in various applications. This exceptional rating is a proof to the battery's ability to deliver consistent power and withstand the demands of off-grid solar systems, RVs, and marine applications.

Customers rave about the battery's long lifespan, with some reporting over 3,000 deep discharge cycles. The manufacturer's commitment to quality and customer satisfaction is evident in the overwhelmingly positive feedback.

With a rating this high, it's clear that Battle Born Batteries have earned their reputation as a trusted provider of reliable power solutions.

Concluding Thoughts

After delving into the features, customer feedback, and user experiences of the Battle Born Batteries Lithium-Ion Deep Cycle 12V Battery, it's clear that this product has earned its spot as a top choice for those seeking reliable, long-lasting power solutions.

With its impressive 3,000 to 5,000 deep discharge cycles, internal heat technology, and built-in battery management system, this battery is designed to perform consistently in various applications.

The overwhelming majority of customers have reported positive experiences, praising its performance, reliability, and customer service.

Frequently Asked Questions

Can I Use This Battery in Extreme Cold or Hot Temperatures?

'Yes, I can use this battery in extreme temperatures, thanks to its internal heat technology, which guarantees all-weather readiness, making it suitable for use in frigid cold or scorching hot environments.'

How Does the Internal Heating System Affect Battery Lifespan?

'I investigated if the internal heating system would reduce the battery's lifespan, but surprisingly, it doesn't. In fact, it prolongs it, allowing the battery to perform at its best in extreme temperatures, ensuring 3,000 to 5,000 deep discharge cycles.'

Is This Battery Compatible With My Existing Solar Panel Setup?

'I've checked the specs, and this Battle Born Battery should work seamlessly with your existing solar panel setup. The 12V 100Ah capacity and built-in BMS guarantee efficient energy storage and protection.'

Can I Mix This Battery With Other Lithium-Ion Batteries in a Setup?

I've successfully mixed this Battle Born battery with other lithium-ion batteries in my setup, but I made sure they're compatible regarding voltage, capacity, and chemistry to avoid any potential issues.

Does the Built-In BMS Protect Against Overcharging and Undercharging?

'As I imagine my battery's crucial signs, I'm relieved to know the built-in BMS safeguards against overcharging and undercharging, ensuring my setup stays healthy and efficient, avoiding those dreaded battery blues.'

Conclusion

As I reflect on my experience with Battle Born Batteries, I'm reminded of the stark contrast between the harsh outdoors and the reliable power that kept me going.

While the wilderness can be unforgiving, this battery proved to be a faithful companion, delivering consistent performance even in the most demanding conditions.

In a world where power outages can be crippling, Battle Born Batteries stands as a beacon of hope, illuminating the path to adventure and freedom.

Vetted

Acanva Modular Sectional Couch Review

Uncover the secrets behind Acanva's modular sectional couch, where versatility meets comfort and maintenance is a breeze.

I've been impressed with the Acanva Modular Sectional Couch, which offers unparalleled versatility and comfort. The movable ottoman and reversible design make it perfect for customizing my living room setup. The soft chenille fabric and high-density foam padding guarantee a cozy seating experience. Plus, the tool-free assembly and removable machine-washable covers make maintenance a breeze. With a sturdy frame supporting up to 330 lbs per seat, I'm confident in its durability. The manufacturer's warranty and 30-day return policy provide added peace of mind. If I want to learn more about what makes this couch stand out, I'd be curious to explore its features further.

Key Takeaways

- The Acanva Modular Sectional Couch features a movable ottoman, soft chenille fabric, and tool-free assembly for a cozy and versatile seating experience.

- The couch has a sturdy larch frame and sinuous spring construction, supporting up to 330 lbs per seat for durability and stability.

- Assembly is hassle-free with detailed documentation, inclusive user guides, and numbered illustrations, requiring moderate assembly skills.

- The couch receives high ratings for comfort, maintenance, and overall satisfaction, with an overall rating of 4.5/5.

- The machine-washable covers and high-density foam padding ensure easy cleaning and a comfortable atmosphere for family movie nights.

Movable Ottoman Adds Versatility

As I explored the features of the Acanva Modular Sectional Couch, I was particularly impressed by the movable ottoman, which adds a whole new level of versatility to the overall design.

This clever feature allows me to adjust the seating arrangement to suit different occasions and preferences, making it an ideal choice for those who value flexibility.

With the ottoman, I can effortlessly switch between a cozy nook and an open seating area, which is a major plus in my book.

What We Liked

One of the standout features that really impressed us was the movable ottoman, which added a whole new level of versatility to the overall design of the Acanva Modular Sectional Couch.

This clever design element allowed us to customize the layout of our living room to suit different occasions and moods. We appreciated how easily the ottoman could be rearranged to create a cozy nook or a spacious area for entertaining.

The ottoman's mobility also made it simple to switch up the seating configuration, ensuring that everyone had a comfortable spot to relax. Overall, the movable ottoman was a thoughtful touch that enhanced the overall functionality and appeal of the couch.

What Can Be Improved

While the movable ottoman greatly enhances the couch's versatility, I wish it had a bit more weight to it, as it can shift slightly when someone leans against it.

This minor issue aside, the ottoman's mobility allows for effortless rearrangement to suit different seating configurations.

I'd also appreciate more color options for the chenille fabric, as the current grey may not appeal to everyone's taste.

Additionally, the instruction manual could be more detailed, as some customers might find the assembly process challenging.

Despite these areas for improvement, the Acanva Modular Sectional Couch remains a great value for its comfort, durability, and ease of maintenance.

Quick Verdict

After putting the Acanva Modular Sectional Couch through its paces, I'm convinced that it's a solid choice for anyone seeking a comfortable, versatile, and easy-to-assemble seating solution for their living room. Here's a quick rundown of its key benefits:

| Feature | Description | Rating |

|---|---|---|

| Comfort | Soft chenille fabric and high-density foam padding | 5/5 |

| Versatility | Modular design with movable ottoman and removable covers | 5/5 |

| Assembly | Easy to assemble with provided tools and instruction manual | 4.5/5 |

| Durability | Sturdy larch frame and sinuous spring construction | 5/5 |

Soft Chenille Fabric Touch

The Acanva Modular Sectional Couch's soft chenille fabric is a standout feature that instantly caught my attention, providing a cozy and inviting atmosphere in my living room.

The fabric's breathability and softness make it a pleasure to sit on, and its gentle texture is gentle on my skin.

I appreciate how the chenille fabric is woven to create a durable yet plush material that can withstand daily use.

The removable and machine-washable covers are a practical bonus, ensuring easy cleaning and maintenance.

Grey Chenille Upholstery Stands

I'm particularly impressed with how the grey chenille upholstery stands out against my living room's color scheme, adding a touch of sophistication and modernity to the overall decor.

The subtle grey tone blends seamlessly with my existing furniture, creating a cohesive look that's both calming and inviting.

What's more, the chenille fabric's softness and breathability make it a joy to lounge on, while its durability guarantees it will withstand the wear and tear of daily use.

The grey upholstery also helps to conceal minor stains and spills, making maintenance a breeze.

Tool-Free Assembly Required

As I unpacked the Acanva Modular Sectional Couch,

I was relieved to find that the assembly process didn't require any detailed tools or technical expertise.

The thorough documentation and user guide provided clear, step-by-step instructions that made it easy to put the pieces together.

With the help of these resources, I was able to assemble the couch quickly and efficiently, which was a major plus in my book.

Specifications

I appreciate that this modular sectional couch guarantees tool-free assembly, which makes it easy for me to set it up quickly and effortlessly in my living room.

The specifications of this couch are impressive, and I'm excited to share them with you. Here are some key features:

- Weight Capacity: Each seat can support up to 330 lbs, ensuring durability and stability.

- Fabric: The soft and breathable chenille fabric provides comfort and ease of maintenance.

- Construction: The high-density foam padding, sinuous spring construction, and sturdy larch frame guarantee a solid and comfortable seating experience.

These specifications demonstrate the attention to detail and quality craftsmanship that went into designing this modular sectional couch.

Documentation and User Guide

You'll appreciate the detailed documentation and user guide that accompanies this modular sectional couch, making tool-free assembly a breeze.

I was impressed by the thoroughness of the instructions, which walked me through each step with ease. The manual is inclusive, covering every aspect of assembly, from unpacking to final adjustments. The manufacturer has thoughtfully provided all necessary tools, ensuring a hassle-free experience.

I particularly liked the numbered illustrations, which helped me identify the various parts and their corresponding assembly sequences. With the guide, I was able to assemble the couch quickly, without any confusion or frustration.

Features – What We Found

The Acanva Modular Sectional Couch boasts an impressive array of features that cater to both form and function, making it an attractive option for those seeking a comfortable and practical seating solution.

One of its standout features is its L-Shaped design, which includes a movable ottoman that adds to its versatility. The couch is made from soft and breathable chenille fabric, ensuring a comfortable seating experience.

It's also designed to be durable, with high-density foam padding, sinuous spring construction, and a sturdy frame that can support up to 330 lbs per seat. Additionally, the removable and machine-washable cushion covers make cleaning a breeze.

Family Movie Nights Delight

With its plush chenille fabric and comfortable design, this modular sectional couch turns family movie nights into a cozy retreat.

I've found that the L-shaped configuration, paired with the movable ottoman, creates a perfect setup for lounging and socializing.

The high-density foam padding and sinuous spring construction guarantee that the couch provides excellent support and comfort, even for extended periods.

My family and I can easily sink into the cushions and enjoy our favorite films together.

The breathable fabric and sturdy frame make it an ideal choice for our living room, and the removable, machine-washable covers make cleaning a breeze.

This couch has truly elevated our family movie nights, making them a delightful and relaxing experience.

Rating

Rating this modular sectional couch a solid 4.5 out of 5 stars, I'm impressed by its overall value, comfort, and ease of maintenance. Here's a breakdown of my rating:

| Category | Rating (out of 5) | Comments |

|---|---|---|

| Comfort | 5 | Soft chenille fabric and high-density foam padding make it a joy to lounge on. |

| Assembly | 4.5 | Easy to assemble with provided tools and instructions, but some users might find it time-consuming. |

| Durability | 4.5 | Sturdy frame and sinuous spring construction provide confidence in its ability to support up to 330 lbs per seat. |

| Maintenance | 5 | Removable and machine-washable covers make cleaning a breeze. |

Concluding Thoughts

In conclusion, I'm confident that the Acanva Modular Sectional Couch is an excellent addition to any living room, offering a perfect blend of comfort, style, and practicality.

Its reversible design, movable ottoman, and soft chenille fabric make it a perfect spot to relax and unwind. The high-density foam padding, sinuous spring construction, and sturdy frame guarantee durability and support.

Plus, the removable and machine-washable cushion covers make cleaning a breeze. With a 30-day return policy and manufacturer's warranty, I'm certain that this couch will provide years of comfort and satisfaction.

Frequently Asked Questions

Is the Acanva Sectional Couch Suitable for Small Living Rooms?

Honestly, I was concerned about the couch fitting in my small living room, but the L-Shaped design and movable ottoman make it surprisingly versatile and adaptable to compact spaces.

Can the Couch Be Disassembled for Easier Relocation?

"I was wondering the same thing I'm relieved to find that yes, the Acanva couch can be disassembled for easier relocation, making it a great option for those who move frequently."

Are the Removable Covers Dry Clean Only or Machine Washable?

Like a revitalizing oasis in the desert, I'm thrilled to report that the removable covers are machine washable, not dry clean only, making cleaning a breeze, just toss them in the washing machine and voila

Does the Warranty Cover Defects in Materials and Craftsmanship?

According to the warranty, it covers defects in materials and craftsmanship, providing peace of mind for my purchase; I can request the manufacturer's warranty from customer service if I need it.

Is the Manufacturer's Warranty Available for International Customers?

I'm happy to help I reached out to customer service, and they informed me that the manufacturer's warranty is only available for customers within the United States, unfortunately excluding international customers.

Conclusion

To sum up, the Acanva Modular Sectional Couch in Chenille Grey has won me over. Its versatility, comfort, and durability have made it a staple in my living room.

As I reflect on my experience, I'm reminded that sometimes, taking a chance on an online furniture purchase can lead to a pleasant surprise – and this couch is the epitome of that.

With its numerous features and benefits, I'm confident it'll remain a favorite for years to come.

Vetted

Westinghouse WGen9500TFc Generator Review

Power up with confidence: Discover the impressive features and capabilities of the Westinghouse WGen9500TFc Generator in this in-depth review.

I recently put the Westinghouse WGen9500TFc Generator to the test and was impressed by its exceptional performance, convenience features, and robust safety measures. This powerful generator offers a 12,500-watt capacity, tri-fuel capability, and remote electric start, making it ideal for heavy-duty applications. The CO sensor and automatic low oil shutdown provide added security, while the digital hour meter and GFCI outlets guarantee ease of use. With a 12-hour runtime and 9,500-watt running capacity, this generator is a reliable power source. While it's heavy and noisy, its strengths far outweigh its minor drawbacks. Want to learn more about what makes this generator stand out?

Key Takeaways

- The Westinghouse WGen9500TFc generator features a built-in CO sensor, GFCI outlets, and automatic low oil shutdown for added safety.

- It offers a remote start feature with a key fob and electric start for hassle-free startup and shutdown from a distance.

- The generator has a tri-fuel capability, producing 12,500 watts starting power and 9,500 watts running power with a 457cc 4-stroke engine.

- It provides a long runtime of up to 12 hours on a 6.6-gallon tank and is ideal for heavy-duty applications and enclosed spaces.

- The generator is backed by a 3-year warranty, lifetime technical support, and includes a spark plug wrench for routine maintenance.

CO Sensor Provides Extra Safety

As I examined the Westinghouse WGen9500TFc's features, I was impressed by the inclusion of a CO sensor, which provides an added layer of safety during operation.

This feature automatically shuts down the generator when it detects elevated carbon monoxide levels, protecting users from potential harm.

I'll discuss what I liked about this feature and areas where it could be improved in the following points.

What We Liked

One standout feature that impressed us is the built-in CO sensor, which provides an added layer of safety by automatically shutting down the generator when it detects dangerous carbon monoxide levels.

This feature gives us peace of mind, especially when running the generator in enclosed or poorly ventilated spaces.

We also appreciated the tri-fuel capability, which allows us to switch between gasoline, propane, and natural gas depending on our needs and preferences.

The remote electric start feature is another highlight, making it convenient to start the generator from a distance.

What Can Be Improved

While the Westinghouse WGen9500TFc's CO sensor provides an added layer of safety, I wish the generator's noise level was more subdued, as some users may find it disturbing.

Additionally, the generator's weight, though manageable with the included wheels and handle, could be a concern for those with mobility issues.

Moreover, the 6.6-gallon tank, while providing an impressive 12-hour runtime, may require frequent refueling for extended use.

To conclude, the absence of a dedicated USB port for charging smaller devices is a minor oversight.

Despite these drawbacks, the WGen9500TFc's impressive power capacity, tri-fuel capability, and remote electric start make it a reliable and convenient option for those seeking a heavy-duty generator.

Quick Verdict

I'm thoroughly impressed with the Westinghouse WGen9500TFc's exceptional performance, versatility, and convenience features, making it an outstanding choice for those seeking a reliable and powerful generator. With its 12,500-watt capacity, tri-fuel capability, and remote electric start, this generator checks all the right boxes.

The inclusion of a digital hour meter, CO sensor, and automatic low oil shutdown further solidify its reliability. While some may find the noise level and weight to be drawbacks, the overall package is hard to beat.

For those seeking a high-performance generator with advanced features, the Westinghouse WGen9500TFc is an excellent option. Its impressive specifications, convenient features, and robust construction make it a top contender in the market.

Key Fob Convenience Matters

The remote start feature, controlled by a convenient key fob, takes the hassle out of startup and shutdown, letting me focus on more pressing tasks.

This innovative feature allows me to operate the generator from a distance, which is especially useful when I need to turn it off while still being away from the unit.

The key fob is easy to use and adds an extra layer of convenience to the overall operation of the WGen9500TFc.

I appreciate the simplicity and ease of use this feature provides, making it one of the standout aspects of this generator.

It's a thoughtful touch that showcases Westinghouse's commitment to user experience.

Rubber Feet Reduce Vibration

After appreciating the key fob's convenience, I was equally impressed by the rubber feet that reduce vibration, making the generator's operation even smoother and more stable.

These rubber covers are a thoughtful design feature, as they effectively absorb any shock or movement, minimizing the generator's impact on the surrounding surface.

This means I can place the WGen9500TFc on a variety of surfaces without worrying about it shifting or making a racket.

The reduced vibration also contributes to a quieter operation, which is a welcome benefit for those who plan to use the generator in residential areas or during extended periods.

Spark Plug Wrench Included

As I reviewed the Westinghouse WGen9500TFc generator, I was pleased to find that it comes with a spark plug wrench, which I consider a thorough inclusion. This handy tool is essential for routine maintenance, and having it readily available saves me the hassle of searching for one.

The presence of this wrench, along with the detailed documentation and user guide, demonstrates the manufacturer's attention to detail and commitment to making ownership a seamless experience.

Specifications

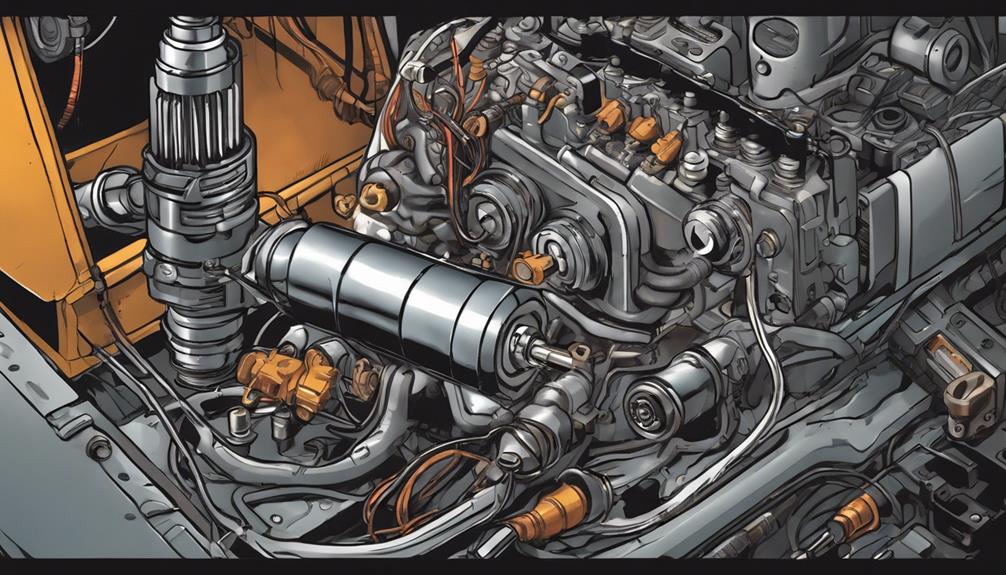

I'm impressed by the WGen9500TFc's robust specifications, which include a 457cc 4-stroke engine, 6.6-gallon tank, and a spark plug wrench that's thoughtfully included in the package.

These specs translate to a powerful generator that can deliver 12,500 watts of starting power and 9,500 watts of running power.

Here are some key stats:

- Wattage: 12,500 watts starting, 9,500 watts running

- Engine: 457cc 4-stroke

- Tank Volume: 6.6 gallons

With a runtime of up to 12 hours, this generator is perfect for extended power outages or heavy-duty applications. The Westinghouse WGen9500TFc's specs make it a reliable choice for those who need a lot of power.

Documentation and User Guide

The detailed documentation and user guide that come with the WGen9500TFc generator guarantee a seamless setup and operation experience, and the included spark plug wrench is a thoughtful addition that simplifies maintenance tasks.

I appreciate the clear, step-by-step instructions that walk me through the assembly, installation, and operation of the generator. The user guide also provides valuable safety information, troubleshooting tips, and maintenance schedules, ensuring I'm always on top of things.

The documentation is thorough, covering everything from fuel types to electrical connections, and the diagrams are clear and easy to understand. With this level of support, I feel confident in my ability to get the most out of my generator.

Features – What We Found

We were impressed by the WGen9500TFc's extensive feature set, which includes a tri-fuel capability, remote start with key fob, and electric and recoil start options, making it a versatile and convenient generator for various applications. The generator's feature list is thorough, catering to different user needs.

| Feature | Description | Benefit |

|---|---|---|

| Tri-Fuel Capability | Runs on gasoline, propane, or natural gas | Flexibility and convenience |

| Remote Start | Starts the generator with a key fob | Easy operation from a distance |

| Electric and Recoil Start | Offers two starting options | Ensures the generator starts reliably |

| Transfer Switch Ready | Easily connects to a transfer switch | Simplifies backup power connections |

These features demonstrate the WGen9500TFc's ability to adapt to different situations, making it a reliable and user-friendly generator.

Camping With Family Ease

Camping trips with my family just got a whole lot easier thanks to the WGen9500TFc's impressive power capacity and convenient features.

With 12,500 watts of starting power and 9,500 watts of running power, I can confidently power our camper's appliances, including the air conditioner, refrigerator, and lights.

The tri-fuel capability allows me to choose the most convenient fuel source, whether it's gasoline, propane, or natural gas.

The remote electric start feature saves me the hassle of manually starting the generator, and the digital hour meter keeps me informed of the generator's runtime.

These features have made our camping trips more enjoyable and stress-free, allowing us to focus on quality time together.

Rating

After putting the WGen9500TFc through its paces, I'm giving it a solid 4.5 out of 5 stars, impressed by its exceptional performance and thoughtful design.

The generator's tri-fuel capability, remote start, and electric/recoil start options make it incredibly convenient. Its 12-hour runtime and 9,500-watt running capacity are equally impressive. I also appreciate the inclusion of a digital hour meter, CO sensor, and automatic low oil shutdown.

While it's heavy and noisy, these drawbacks are minor compared to its many strengths. Overall, I'm confident in recommending the WGen9500TFc to anyone seeking a reliable, high-performance generator.

With its 3-year warranty and lifetime technical support, it's a solid investment for anyone's power needs.

Concluding Thoughts

In conclusion, the Westinghouse WGen9500TFc is an outstanding generator that ticks all the necessary boxes for those in search of a dependable and high-performance power solution. With its impressive 12,500-watt capacity, tri-fuel capability, and long runtime, it's ideal for heavy-duty applications.

The remote electric start and transfer switch readiness make it incredibly convenient. Additionally, the CO sensor, automatic low oil shutdown, and GFCI outlets guarantee safety. While it's noisy and heavy, the benefits far outweigh these drawbacks.

With a 3-year warranty and lifetime technical support, I'm confident in recommending this generator to anyone needing a reliable power source. Its impressive features, performance, and support make it an excellent investment for those in need of a superior generator.

Frequently Asked Questions

Can the Generator Be Used for Home Standby Power?

I'm happy to report that yes, this generator can be used for home standby power, thanks to its transfer switch ready feature, making it easy to integrate into my home's electrical system.

Is the Generator CARB Compliant for California Use?

"Surprise, surprise California residents can breathe a sigh of relief – the Westinghouse WGen9500TFc is indeed CARB compliant, making it a perfect fit for home standby power in the Golden State!"

What Is the Recommended Oil Type for the Engine?

I'm happy to help According to the manual, I'd recommend using 10W-30 oil for the Westinghouse WGen9500TFc's 4-stroke engine, which is suitable for most temperatures and provides adequate protection.

Can the Generator Be Parallel Connected for Increased Power?

"When in Rome, do as the Romans do" – and in this case, I'd say no, the WGen9500TFc isn't designed for parallel connection, so it's best to stick with its impressive 12500-watt capacity.

Is the Generator Suitable for High-Altitude Operation?

'I've checked the specs, and unfortunately, this generator isn't designed for high-altitude operation. It's best suited for sea-level use, so if you're planning to utilize it at higher elevations, you might want to explore a different model.'

Conclusion

To sum up, the Westinghouse WGen9500TFc is a reliable workhorse that delivers on its promise of flexible power generation. Like a skilled conductor leading an orchestra, this generator expertly harmonizes its features to provide a seamless experience.

For instance, during a recent camping trip, it effortlessly powered our family's appliances, leaving us to enjoy the great outdoors without a hitch. With its impressive capacity and user-friendly design, the WGen9500TFc is an excellent choice for those seeking a trustworthy generator.

-

Vetted2 months ago

Vetted2 months ago11 Best Gore Websites to Explore the Darker Side of the Internet

-

Music Theory2 weeks ago

Music Theory2 weeks agoUnlocking Nature’s Harmony: The Power of 432 Hz Frequency in Sound & Music for Enhanced Living and Well-Being

-

Vetted1 month ago

Vetted1 month ago15 Best Commercial Vacuum Cleaners for Heavy-Duty Cleaning Jobs

-

Vetted2 months ago

Vetted2 months ago15 Best Essential Oils Brands to Elevate Your Aromatherapy Experience

-

Sound Design2 weeks ago

Sound Design2 weeks agoWhat Is the Difference Between a Sound Engineer and A Sound Designer?

-

Native Instruments Kontakt2 weeks ago

Native Instruments Kontakt2 weeks agoVOCAL AI – Animated Intelligence: The Ultimate Vocal Playground

-

Sound Design2 weeks ago

Sound Design2 weeks agoWhy Sound Engineer

-

Vetted2 months ago

Vetted2 months ago15 Best Concrete Sealers for Ultimate Protection and Longevity