The average person needs to work for over 40 hours a week just to survive. That is why so many people are looking for ways to create passive income that will allow them the time and freedom they need in order to live the life of their dreams! This article provides 12 ideas on how artists can earn progressive passive income in 2022, allowing you more time and freedom than ever before!

12 Passive Income Ideas For Artists to Make More in 2022

The average person needs to work for over 40 hours a week just to survive. That is why so many people are looking for ways to create passive income that will allow them the time and freedom they need in order to live the life of their dreams!

The rise of passive income in the arts is a great thing. Artists can create with less regard to market trends and what they think will sell, and focus on doing their art for themselves. Passive income from these endeavors can be more lucrative than when artists are beholden to the whims of the marketplace, which might not always be receptive to their work. In this blog post, we’ll explore 12 ways that you can earn progressive passive income as an artist!

How do artists make money in 2022?

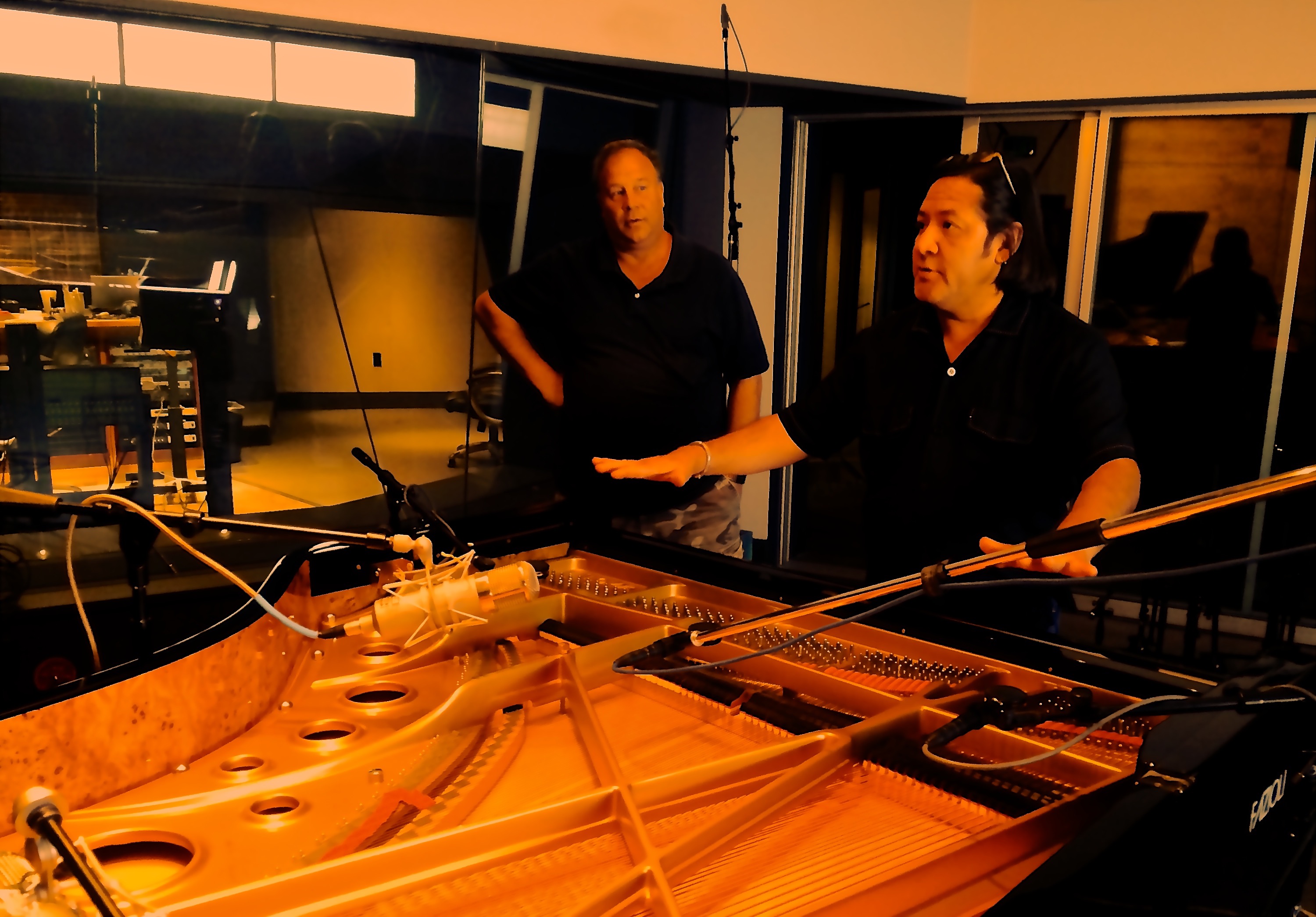

There are so many ways that an artist can make money in 2022, it’s hard to say which one is “best”! It depends on your goals. If you want the most passive income possible, then you should look for ways to invest your time and effort into activities that you can do periodically. Options could include making crafts or jewelry to sell at craft fairs or boutiques, or self-publishing your own books.

If you want to make more money now but don’t mind putting in more effort, then you should try doing gigs like playing music at weddings or making commission paintings for others! The easiest way to make passive income as an artist is by doing what you love and getting paid for it too!

Legacy or old 12 Passive Income Ideas For Artists to Make More

- Start your own small business!

- Offer services for hire!

- Write articles to create multiple streams of revenue!

- Sign up for freelance work with companies that need artists on staff!

- Sell artwork, jewelry, or other items you make yourself!

- Sign up for an online course to learn new things about your craft!

- Use the internet well to earn money without leaving home!

- Start a Youtube channel with tutorials and other useful information about your art form to help others learn what you know!

- Promote yourself on social media by sharing links, posts, and photos that are related to your work to show off what you can do!

- Commit to doing your art every day for at least an hour, no matter what!

- Join a community of artists who support one another in their goals!

- Create a blog

How do you make passive income in creatives?

There are so many ways that an artist can make money in 2022, it’s hard to say which one is “best”! It depends on your goals. If you want the most passive income possible, then you should look for ways to invest your time and effort into activities that you can do periodically. Options could include making crafts or jewelry to sell at craft fairs or boutiques, or self-publishing your own books.

If you want to make more money now but don’t mind putting in more effort, then you should try doing gigs like playing music at weddings or making commission paintings for others! The easiest way to make passive income as an artist is by doing what you love and getting paid for it too!

Let’s focus on new ways on how to make passive income.

Ways to Earn Passive Income with Crypto

Disclaimer: StrongMocha and the article author is not an “Expert”. Please do your own research, come to your conclusions & make your own mistakes! Everything written here is for fun as a hobby and entertainment for you, the reader. To be clear it is for entertainment purposes only and is never intended to be financial investment advice. StrongMocha owns or has owned cryptocurrency and associated hardware. We may receive donations or sponsorships in association with specific content creation. StrongMocha may receive compensation when affiliate/referral links are used. StrongMocha is never liable for any decisions you make.

If you’re looking to make some passive income by speculating on crypto, something like trading Bitcoin is a great way to do it. The idea of this sort of trading is that you can buy and sell at the same time (without having to keep your computer turned on or anything like that), and as long as the value fluctuates in your favor, you’ll be able to earn money. It’s not for everyone, but it can be an easy way to make some serious money if you take the time to learn how to use cryptocurrency exchanges well.

Is staking crypto passive income?

Staking crypto is a practice of transferring the ownership stake from the user to a specific network. It is usually done as a form of providing collateral for services, such as maintaining a blockchain.

Staking is the practice of providing liquidity to a platform in exchange for rewards (interest/yield). Using this method, you can earn block rewards and (master)nodes in the network by assisting out the blockchain of the stakes Crypto.

Is staking crypto profitable?

Staking crypto is a form of earning money from a stake in the currency. It will depend on the cryptocurrency and staking platform, but in general, the more currency you stake, the higher your income. It comes with high risk to loose all your money.

Is staking worth it crypto?

Staking is an act of depositing cryptocurrency to the platform in order to earn rewards. The most common type of staking is Proof-of-Stake or PoS, which requires a smaller amount of upfront capital and offers a larger potential return. Staking can be either short-term or long-term depending on how often you choose to stake your crypto. If you stake too often, it could result in a loss as your deposit will have been used for staking before it has had time to grow. If you stake too seldom, then you may miss opportunities that may be given by the network as rewards for staking.

Can you lose crypto staking?

You can lose crypto staking. If you stake too often, it could result in a loss as your deposit will have been used for staking before it has had time to grow. If you stake too seldom, then you may miss opportunities that may be given by the network as rewards for staking.

Does your crypto grow while staking?

You can stake cryptocurrency on the platform. This will be rewarded by either block rewards or Master-Nodes. It also comes with a high risk to lose all your crypto if you are not careful.

Is the crypto investing platform DeFi a good investment?

DeFi is an abbreviation for Digital Finance. The platform makes use of smart contracts to create tokens that represent products, stocks, or commodities. These tokens are then made available to investors for purchase or trade. The market value of the tokens will then be determined by the value of the underlying asset which is being represented by the digital token.

Can I make money with DeFi?

By staking the assets you own into DeFi protocols, it’s possible to earn profit commonly referred to as “yield” which allows for the exponential growth of your crypto stack without risking any capital through trading or other economic activities.

Is DeFi a good investment?

The flexibility of DeFi, along with the continued expansion of the market, makes it an appealing and potentially extremely lucrative investment. There are, however, many risks associated with investing in cryptocurrencies. Market participants should be aware of them before diving in.

The potential benefits of investing in DeFi?

Increased liquidity- This is increased because investors can buy and sell these digital tokens over an open marketplace which also means they can find more buyers for their transaction than just one or two buyers on a traditional stock trading platform.

Increase in interest rates- This increase is due to people using the DeFi platform to lock up their crypto in order to earn interest from the cryptocurrencies that have been deposited. This is also known as staking and there are a number of different protocols available which can be used by investors for this purpose.

Increase in value- As well as providing an opportunity for users to generate income, digital tokens will offer increased liquidity due to being able to buy and sell them on open exchanges. The increase in demand should see stability becoming available via loan contracts too, meaning a better market price could soon follow.

What types of risks do you face when investing with DeFi?

Market volatility- Cryptocurrencies enjoy swings in both directions at various times throughout the year which means come with risk attached even though it is possible to mitigate this risk with the increase in liquidity.

Security- Investing in cryptocurrencies comes with a number of security risks that can be mitigated by not storing your funds on exchanges and keeping them offline when they are not needed for trading purposes. It is also important to make use of hardware wallets like Trezor or Ledger which will provide physical access protection and help protect against malware attacks respectively.

How do I get started investing in DeFi?

Beginners who wish to invest in DeFi should consider signing up for an account on one of the many online cryptocurrency exchange platforms such as Binance, Coinbase, Bitfinex etc. before looking into digital finance protocols themselves where you can begin buying tokens once registered successfully after completing the KYC process.

Where can I find out more about investing in DeFi?

In order to gain a better understanding of the various risks involved with digital finance, it is recommended that you research each protocol on offer yourself before deciding whether or not they are suitable for your investment needs. You should also consider speaking with an independent financial adviser if you have any queries regarding these protocols and how best to apply them within your own trading strategy.

What do I need to get started?

In order to start staking tokens that represent assets such as stocks or commodities, investors will require some form of cryptocurrency wallet where they can store their funds securely until being ready to transfer via exchange platforms when required. Some exchanges might allow traders from specific countries while others might restrict the type of tokens that can be traded in or even where they are allowed to reside.

How do I start staking and generating interest?

Staking is usually done via a smart contract with some exchanges offering very simple instructions on how to set up an account for this purpose, while others might require specific documentation before allowing you access so it’s important to familiarise yourself with their terms & conditions first if applicable. A good place to get started would be Bitfinex who has made things easy by providing step-by-step guides which will help users navigate the process without any problems.

What happens if the protocols I invest in cease trading?

Many of these DeFi protocols have been created by developers who may even release a source code on Github allowing anyone to use the protocol but there’s no guarantee that they will continue providing support once launched. In most circumstances, it would simply allow users to redeem funds immediately without requiring anything from exchanges themselves apart from potentially updating interface features where necessary which might require traders upkeeping their own security measures too.

How do I know which protocol to invest in?

Beginners should review the various investment protocols available before deciding which one you wish to buy into with a simple Google search providing plenty of information about each offering, including their stage of development and whether or not they have been audited by external companies. Make sure you do your own research too where possible though as some DeFi networks might be scams looking for easy targets from inexperienced investors who are new to this type of trading.

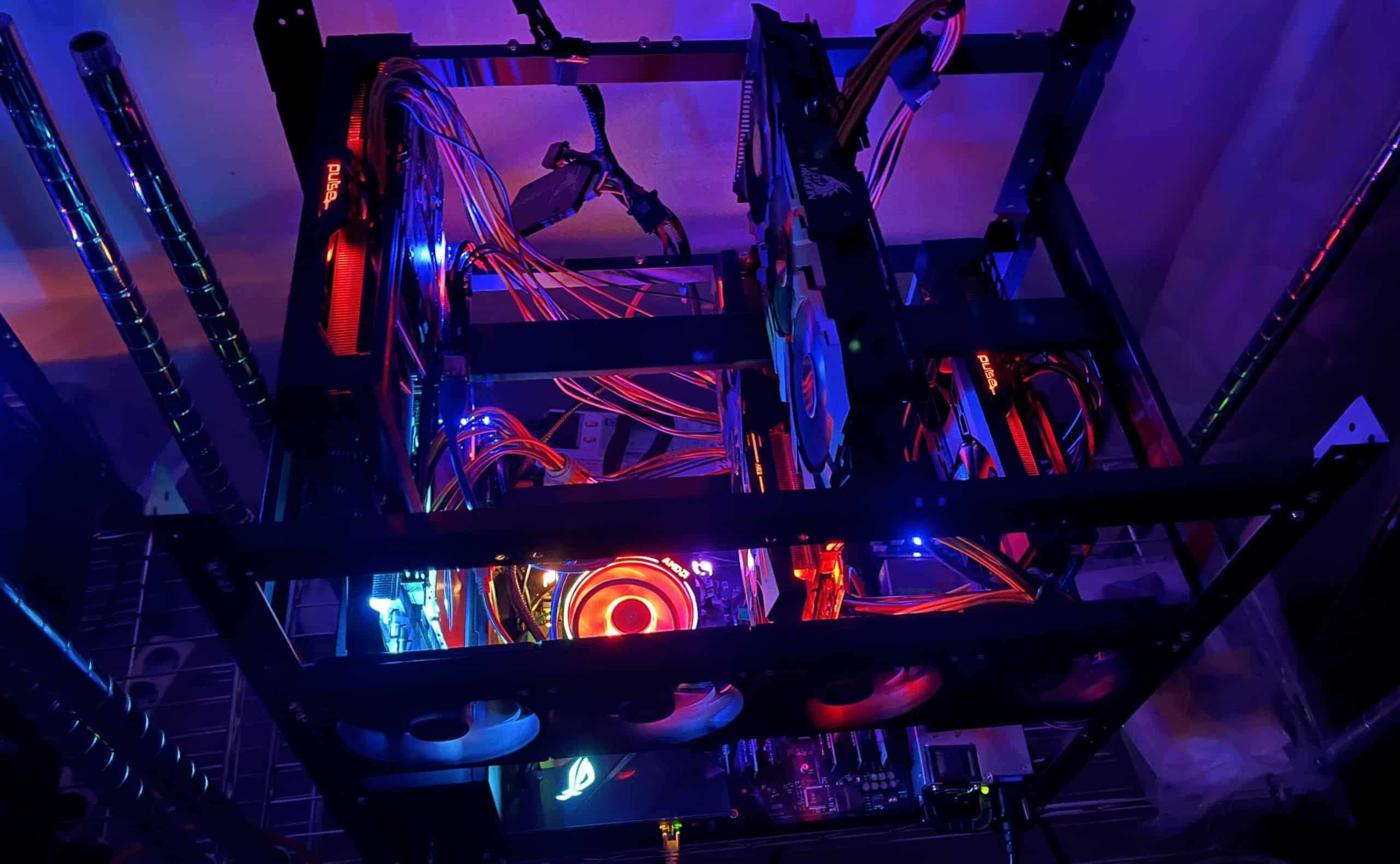

Is mining cryptocurrency passive income?

Cryptocurrency mining, in general, is not passive income, but some cryptocurrencies can be mined passively. Passive mining refers to the act of mining without investing significant funds in the equipment. Proof-of-stake coins like Ethereum and Peercoin can be mined without investing anything other than the energy to run your computer and maintain the blockchain ledger. Other cryptocurrencies like Bitcoin can also be mined profitably with just your computer because ASICs are too expensive for consumer-level hardware.

Can you make passive income with crypto?

No, mining cryptocurrency is not a passive income. However, some cryptocurrencies can be mined passively. Passive mining refers to the act of mining without investing significant funds in the equipment. Proof-of-stake coins like Ethereum and Peercoin can be mined without investing anything other than the energy to run your computer and maintain the blockchain ledger. Other cryptocurrencies like Bitcoin can also be mined profitably with just your computer because ASICs are too expensive for consumer-level hardware.

What is required to mine cryptocurrency?

What is required to mine cryptocurrency? Mining cryptocurrency means that you are contributing your computer’s processing power to solving cryptographic puzzles which are part of the mining process. This may or may not require investing in equipment depending on the cryptocurrency being mined.

A mining operation typically has three basic components: the wallet, software, and hardware. It is essential to have a place for your cryptocurrency so you don’t lose any of it if successful in converting these tokens or coins into real money!

Too Late to Mine Crypto – Should I still try to mine cryptos or Is it too late?

If you are just getting started in the cryptocurrency world, it can be difficult to figure out what coin is worth mining. Cryptocurrencies require time and energy to mine, so if you pick the wrong one then your efforts may not produce any rewards. Cryptocurrency’s market value fluctuates constantly which makes it difficult to determine a fair price for them as well. In this video, we will review some of the most popular cryptocurrencies and discuss why they make good choices for new miners!

The process by which transactions on a blockchain network are verified and added to the public ledger (the “blockchain”) and also the means through which new cryptocurrency is released. Mining involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle. The participant who first solves the puzzle gets to place the next block on the blockchain

A digital currency that uses cryptography for security; Bitcoin is one of several cryptocurrencies. Digital currencies are based upon cryptography for security, making them theoretically immune from counterfeiting, double spending, etc. Cryptocurrencies have no borders or central banks controlling their value; they use peer-to-peer technology instead of centralized ledgers

What is Mining?

The process by which transactions on a blockchain network are verified and added to the public ledger (the “blockchain”) and also the means through which new cryptocurrency is released. Mining involves compiling recent transactions into blocks and trying to solve a computationally difficult puzzle. The participant who first solves the puzzle gets to place the next block on the blockchain.

Non-Fungible Tokens explained

What are non-fungible tokens? They are digital assets that have a unique identity and can be used to represent anything from an in-game item to a share of stock. Non-fungible tokens are very different than fungible ones, which are things like bitcoin or litecoin – one is not more valuable than the other because they’re all the same. Instead, each token has its own value based on what it’s being used for. That makes them much more interesting!

A Non-Fungible Token ( NFT ) is a type of digital content that can only exist one place at a time. It’s like an item you would find in nature, such as apples or oranges; each person holding it has their own unique piece because no two apples will ever look exactly alike!

For more and to learn more about NFT take a look here.

More Information

Exploration of Web 3.0: What Is It, Why Is It Important?

Conclusion

Beginners should review the various investment protocols available before deciding which one you wish to buy into with a simple Google search providing plenty of information about each offering, including their stage of development and whether or not they have been audited by external companies. Make sure you do your own research too where possible though as some DeFi networks might be scams looking for easy targets from inexperienced investors who are new to this type of trading.

There are some cryptocurrencies that can be mined passively which means you won’t have to invest any equipment into the mining process unlike Bitcoin or other Proof-of-Work currencies where ASICs are too expensive for consumer-level hardware and instead rely on your computer’s processing power to solve cryptographic puzzles which are part of the mining process.

What is required to mine cryptocurrency? Mining cryptocurrency means that you are contributing your computer’s processing power to solving cryptographic puzzles which are a part of the mining process. This may or may not require investing in equipment depending on the cryptocurrency being mined.